Faster, Simpler, Smarter Real Estate

Parcl gives you daily signals, clean ownership data, and simple tools that help you understand how housing markets are moving.

Trusted by leading operators and featured in:

Announcing Our Latest Partnership

Real Estate Markets Meet Prediction Markets

Try Portfolio Hunter

Find Every SFR Portfolio in Your Target Market

Try Dealflow

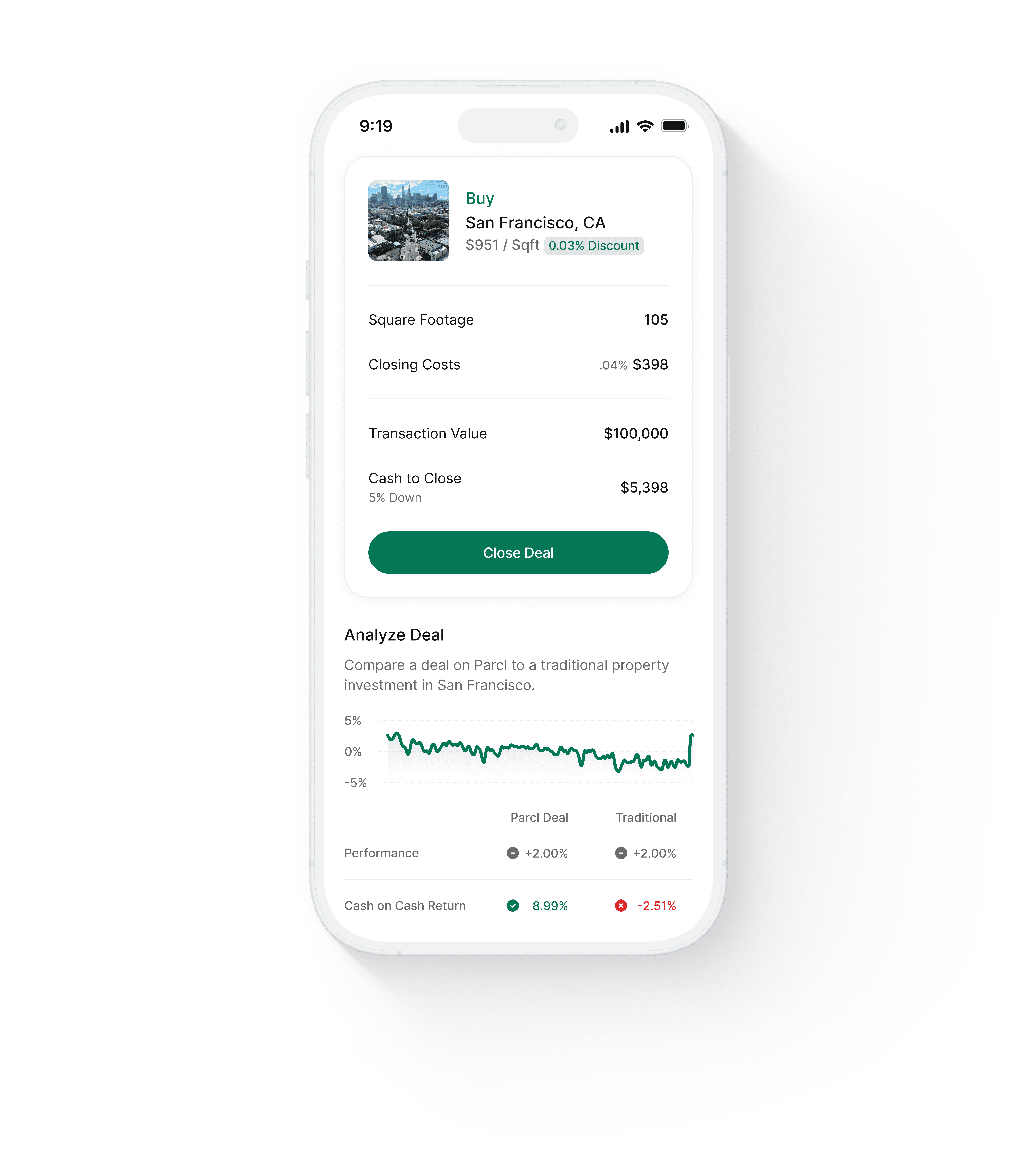

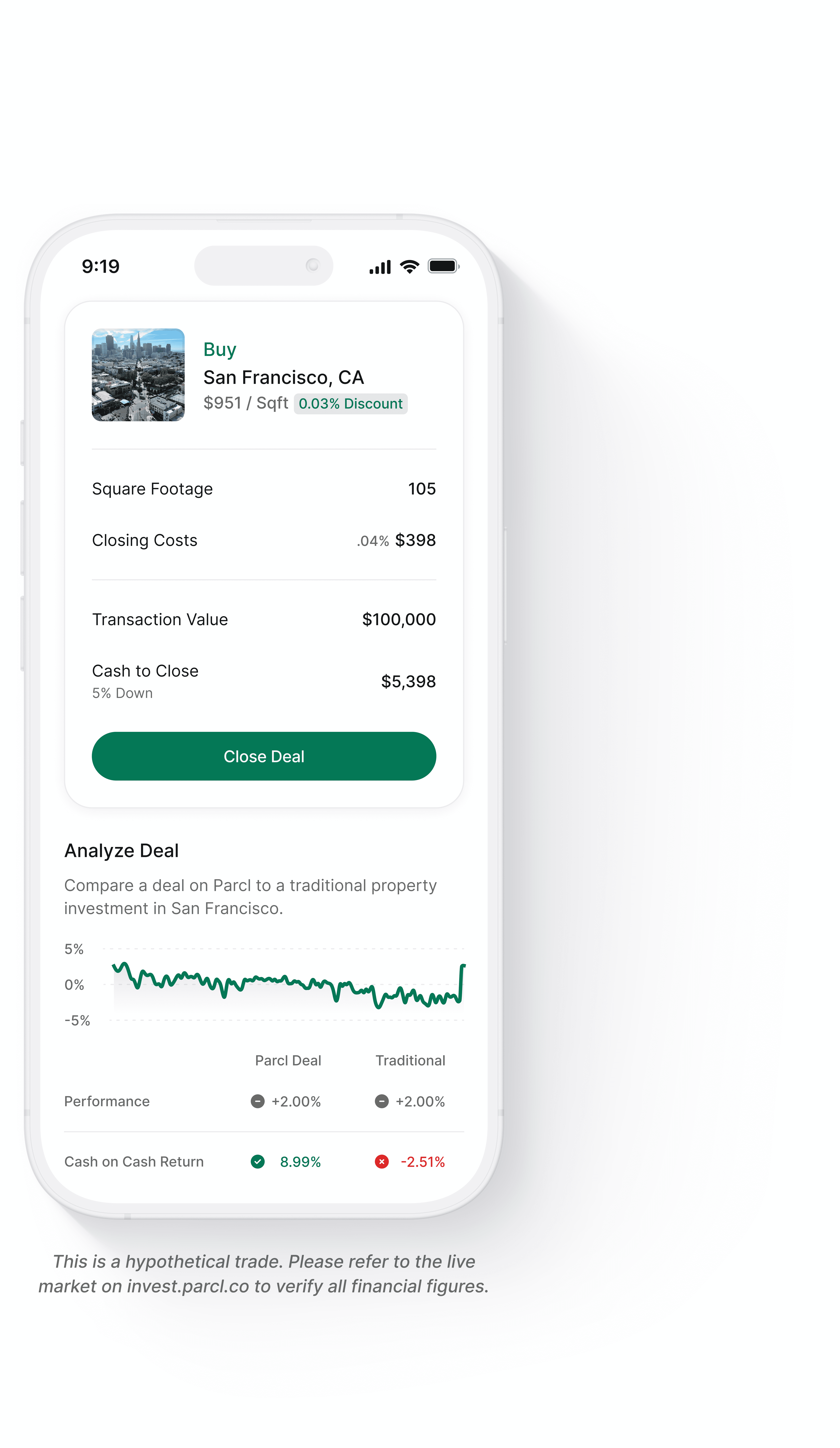

Trade Housing Markets like Stocks

Pick a Market

Choose Direction and Set Size

Analyze Your Deal

Close in Minutes

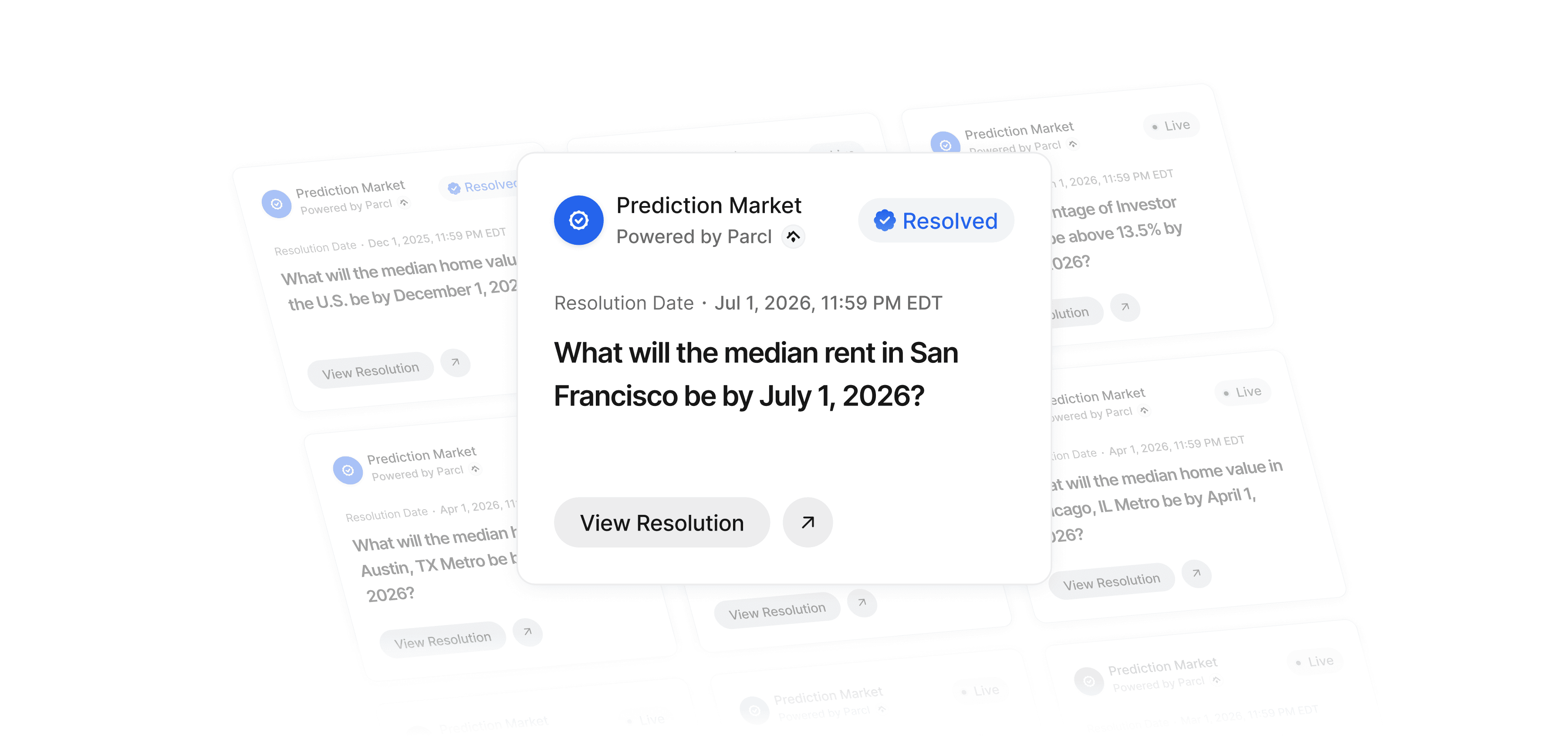

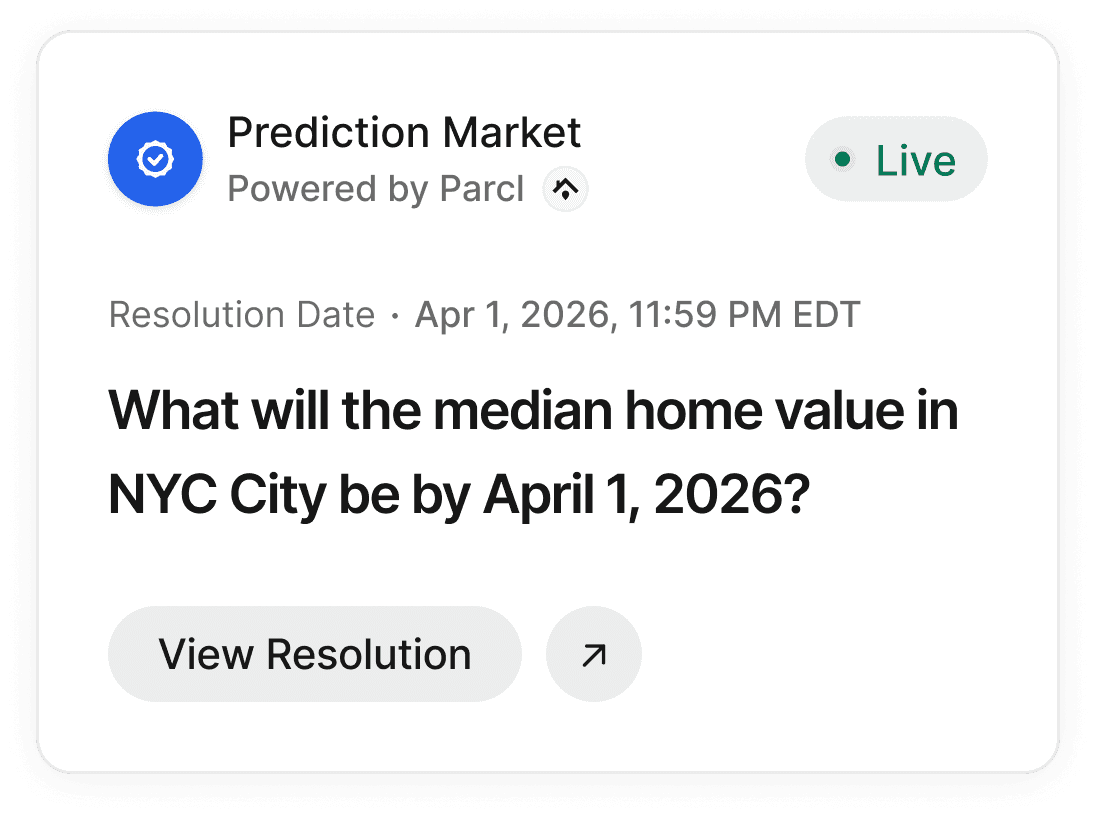

View Resolutions

Verify Prediction Market Outcomes

Parcl does not create, list, or offer any prediction markets. Parcl solely provides independent data and resolution services for markets offered by various outlets.