Digital Real Estate: 10 Statistics That Prove Blockchain Can Help The Real Estate Sector

Blockchain technology isn't just distributing finance and big tech. Here's 10 statistics proving that blockchain can improve the real estate industry for the better.

Parcl Team

Aug 1, 2022

1. Real estate is a scammers paradise

There was an 1100% rise in reports of Business Email Compromise (BEC) scams involving real estate transactions and a 2200% increase in reported monetary losses.

By keeping all transactions on one platform backed by the blockchain, real estate transactions could become more secure and transparent.

2. Prices just keep going up, up and up

In Q1 of 2022, the median house price had risen to $429,000, making real estate exposure a distant dream for many.

By removing middlemen from the equation using blockchain technology, you could save up to $30,000 in fees for a home of this value.

3. Fraudsters no more!

In 2021, mortgage application fraud was evident in 1 out of 120 applications. Using technology such as smart contracts, mortgage lenders could build code that quickly scans applications for fraudulent information, saving hours of work time.

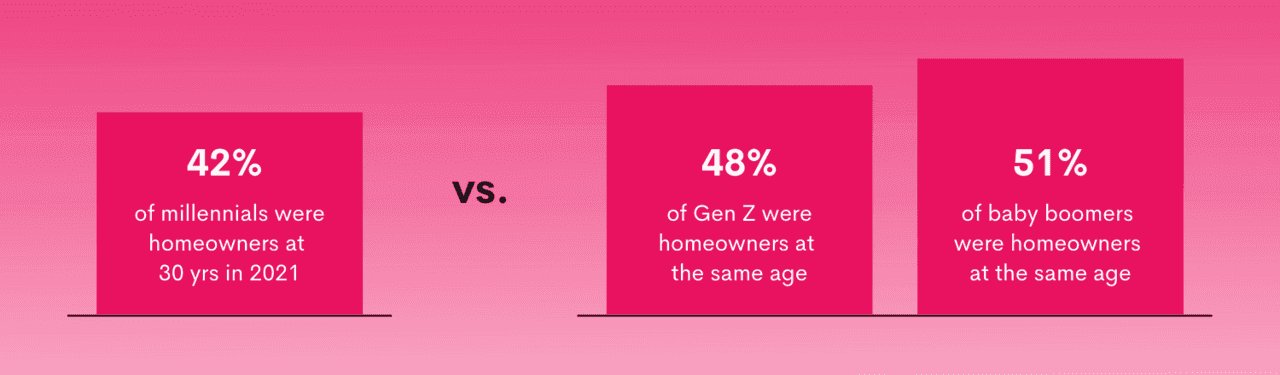

4. Boomers had it good

In 2021, just 42% of millennials at age 30 were homeowners, compared to 48% of Gen Z and 51% of baby boomers when they were the same age.

Exposure to the real estate market is now a distant dream for many, but with the help of protocols like Parcl, it'll be cheaper than ever before to invest in real estate.

5. Prices up, wages plateau

Americans need an average income of $144,192 to afford a house. Whereas the median household income currently sits around $60,178, far less than what is needed.

Thanks to Covid, homes now cost 5.4 times more, on average, than a typical buyer's gross income.

But, this trend was here long before Covid; since 1965, home prices have surged an astonishing 118% compared to an income increase of just 15% in the same period.

6. Visibility of building materials

The National Association of Homebuilders (NAHB) says that in 2021, more than 90% of builders reported delays and materials shortages.

Retailers like Home Depot have invested millions of dollars in serving the market in this crisis state. Interestingly, Home Depot has already implemented IBM's Blockchain technology to manage disputes within its supply chain more efficiently.

The traceability improves the overall efficiency of the supply chain, making materials cheaper and easier to source.

7. Crypto mortgages are on the rise

Millennials will account for 45% of mortgages on the market. On average, it takes around 60 days for a lender to approve a mortgage application. Crypto mortgage platforms such as Milo help reduce the time needed to purchase a home.

Typically, crypto mortgage lenders don't require credit checks; this could be a good way for those with bad credit to buy their own property. It could also be helpful for those that don't want to pay tax on their cryptocurrency gains.

8. Lower fees

There are quite literally dozens of fees priced into real estate closing costs, from appraisal fees to escrow fees; you can expect a closing charge between 2% and 5% of the overall property value.

Currently, the median home price for 2022 sits at $428,700, meaning you could pay between $8,574 and $21,435.

If you removed much of the bureaucracy and manual paperwork needed by utilizing smart contract technology and other blockchain features, you could bring these fees down significantly. For example, a transaction on the Solana blockchain only costs $0.00025.

9. Keeping up with technology

45% of brokers report that "keeping up with technology" is their agents' biggest challenge.

However, with 107,000 brokers operating within the US alone, this number is climbing, and it's becoming increasingly harder for brokers to distinguish themselves from the competition.

Some brokers have turned to platforms like Propy, which make the entire process of buying or selling a property completely digital and on one platform; this minimizes the risk of fraud and scams and reduces the processing time using Web3 technology.

10. No money to invest

42% of non-homeowners (including renters) state that their low income is a barrier in their efforts to buy homes. 37% also cited that they didn't have enough saved for a down payment.

In our opinion, exposure to the real estate market is a pillar of the "American Dream" and will most likely be the largest investment many people will make.

This is why Parcl has made it its mission to open this market to the millions of people currently priced out of investing in real estate by using the advantages of Blockchain technology.

Shared content and posted charts are intended to be used for informational and educational purposes only. Parcl does not offer, and this information shall not be understood or construed as, financial advice or investment recommendations. The information provided is not a substitute for advice from an investment professional. Parcl does not accept liability for any financial loss or damages. For more information please see the terms of use.

Parcl Team