How to Make Money in Real Estate

There are plenty of ways to make money in real estate but only a few are actually worthwhile. Here are a few ways you can make money in real estate.

Parcl Team

Aug 1, 2022

Believe it or not, there are plenty of ways to make money from investing in real estate. The two most obvious are an increase in property value and rental income.

But, you can use several other methods to profit from real estate, and they don’t require grand strategizing. You’ll be happy to know.

We’ll show you some real ways to profit from real estate that don’t all require waiting years for the property to appreciate or cater to tenants 24/7.

Not only that, by the end of this article you’ll know whether traditional real estate investing is really worth it or if the latest alternative methods will be the way to go.

Profit Through Appreciation

According to Fortune magazine, real estate value is expected to grow by 15% in 2022.

Meaning that if you buy a property now, you could see a healthy profit if you decide to sell this time — January — next year.

But, just holding a property won’t ensure profit; a few other factors could determine whether the property increases or decreases in value.

Renovation

People underestimate the value of a modern bathroom or kitchen and some freshly painted walls. This is the most common way of increasing the value of a property.

This doesn’t mean you immediately sell the property; if you’re saving for retirement, this could be your nest egg until that point.

Slowly but surely, extending the home or improving the interior so that one day, once the kids move out, you can sell and downsize with a considerable amount of cash in your back pocket.

Land Development

Undeveloped land is another method of profit through appreciation an investor can get involved in.

The value of the land could increase if its natural resources can be harvested, such as timber, oil, water, or rare minerals. Companies would pay to own the rights to collect resources like this.

Another option would be to buy land on the outskirts of large cities or areas seeing a growth in population. Developers will be keen to buy the land once the area of the community begins to expand to accommodate a larger population.

You’ll also notice that if you buy a property and the community begins investing in its infrastructures, such as better roads or amenities like schools, hospitals, parks, and so on, the property’s value will increase.

Income-Based Profit

Consistent income streams can be much more valuable than outright selling the property for a profit. Income such as rent or royalties offers regular cash payments and the most valuable commodity of all; more time.

Flipping Homes

A flipper is someone who finds run-down houses and renovates them back to being habitable or simply modernized with quality appliances. They do this quickly and sell them for a profit using marketplaces like Zillow.

There are a few risks to this, such as unexpected costs, changes in the market, or even a lack of interested buyers. If you want to read more about flipping homes, check out our article on the BRRRR real estate investing method.

Royalty Payments

If you have the rights to the land, you could rent the land out to various companies like logging companies to harvest timber. Or, if you have other natural resources on your land like oil or rare minerals that can be mined, companies will happily pay big bucks to get rights to access them.

Residential / Commercial Rent

Renting out accommodation or commercial space is likely the most common way to make money from real estate. If you’re looking to rent out a single-family home, it’ll easily net you a decent income.

Many landlords out there rent out multi-family homes while living in one of the units themselves; this allows you to minimize your housing costs by having other tenants, in theory, pay your expenses and mortgage.

If you’re operating a multi-family unit or a collection of single-family homes, collecting rent, carrying out repairs, and other admin can become quite the chore. Instead, most people just hand over those tasks to a property manager for a percentage of the monthly income.

The issue with rental properties is that finding tenants to stay long-term can be difficult. Also, your rental property’s neighborhood can quickly evolve into an unattractive area with increased crime rates, lack of amenities, or suitable infrastructure.

Ultimately, the success of rental properties is determined by several factors out of your control, and a lack of control only increases the risk factor.

Airbnb Rental / Vacation Homes

Probably the most lucrative option out of the above. Airbnb has quickly become one of the most popular options for homeowners to bring in additional income by utilizing spare rooms or their entire home when they’re not using it.

With Airbnb and vacation homes, location is an essential factor when looking to be profitable. If you’re in a tourist spot or close to one, that’s ideal. Still, other benefits like nearby train or bus depots and parks will affect your tenancy rate and overall profit intake.

The one issue with Airbnb is that if your listing is popular, you’ll be playing maid quite often between guests arriving. You’ll also be expected to be on call whenever the guest requires help or answers. However, this option is usually incredibly profitable when taken seriously.

Alternative Real Estate Income

The options mentioned above are the most common for the average real estate investor to take advantage of. This section describes methods that aren’t immediately obvious or as well known

REITs

REITs are basically large funds that own swathes of real estate, which allow investors to purchase shares in return for dividends, made up of the rent payments of these properties. REITs are a way for the owner to purchase more properties but with another person’s money.

The downside to investing in a REIT is that you don’t have direct control over allocating your funds, unlike traditional investing. This method is more likely to benefit those who can’t afford a physical property but still want exposure to the market.

Parcl: Digital Real Estate Investing

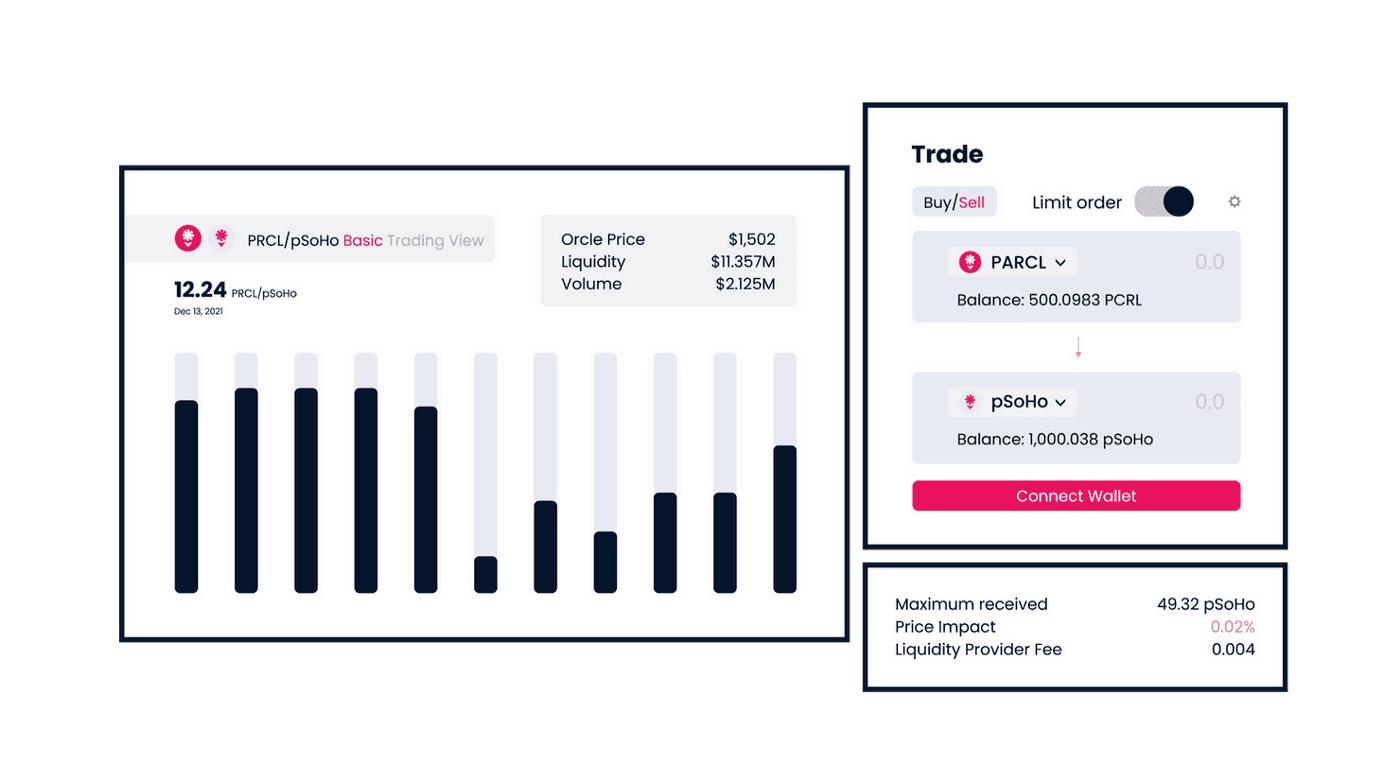

By using Parcl, you’ll be able to invest in your favorite neighborhoods along with broad or highly granular exposure to other high-value real estate.

The Parcl platform is the first of its kind built on the Solana blockchain that’ll allow investors to actively, long or short real estate assets.

Thanks to the blockchain-based trading system, you’ll benefit from immediate liquidity, low transaction fees, and no minimum investment.

Join our waitlist and discord if you’re interested in hearing more about how you can trade real estate like you would Stocks, Crypto, or ETF’s. Parcl gives you the ability to invest in real estate without having to own a physical property. If you want to learn more about how Parcl is making it easier to invest in real estate, take a look at our intro to Parcl article.

Metaverse Land Ownership

Metaverse land prices have been surging lately, with all of the hype from Meta, formerly Facebook, entering the digital reality space.

Buying and selling digital land has become a lucrative business, with sales reaching over the $1 million mark.

Landowners within certain virtual worlds have also been actively renting out their land to companies looking to market their products and services within the Metaverse. Although, there are a few downsides to owning Metaverse land.

The biggest concern would be that you’re not guaranteed the security of the virtual world existing in the future. The project could easily and quickly fail, taking your million-dollar virtual property and tenants with it.

If you’re still keen to get involved in Metaverse real estate, make sure you buy from a reputable and popular project like Sandbox or Decentraland. But, the prices are getting steeper, so the barrier to entry is pretty high. Coincidentally a similar problem to the real world.

Conclusion

There are many other ways real estate can make you money, like short sales, contract flipping, lease options, and much more.

But, the methods mentioned above are the most straightforward, ideal for the beginner real estate investor, and pretty lucrative if you spend the time to do your own research.

However, the reality of investing in real estate is that even the methods that are supposed to reduce the time and risk involved before you profit from real estate are still quite lengthy and risky compared to our method of investing, Parcl.

Traditional real estate investing is full of risks, like unexpected payments, repairs, delays, and lack of security when renting. With Parcl, you can profit regardless of the state of the real estate market.

With Parcl, you’ll have immediate liquidity, a straightforward platform, real-time data to make informed decisions, and the ability to invest in real estate without needing thousands of dollars in capital.

Follow us

🌐 Join our Waitlist: https://parcl.co

🐤 Twitter: https://twitter.com/Parcl

🏡 Discord: https://discord.gg/zWxp2JupNA

Shared content and posted charts are intended to be used for informational and educational purposes only. Parcl does not offer, and this information shall not be understood or construed as, financial advice or investment recommendations. The information provided is not a substitute for advice from an investment professional. Parcl does not accept liability for any financial loss or damages. For more information please see the terms of use.

Parcl Team