Market Report: April 27 2023

8 new Parcl markets launched this week. Miami, LA, Philly & Brooklyn rose faster. Traders generally long, only SF & LA skew short. Volatility subdued.

Parcl Team

Apr 27, 2023

What Parcl Traders Need to Know

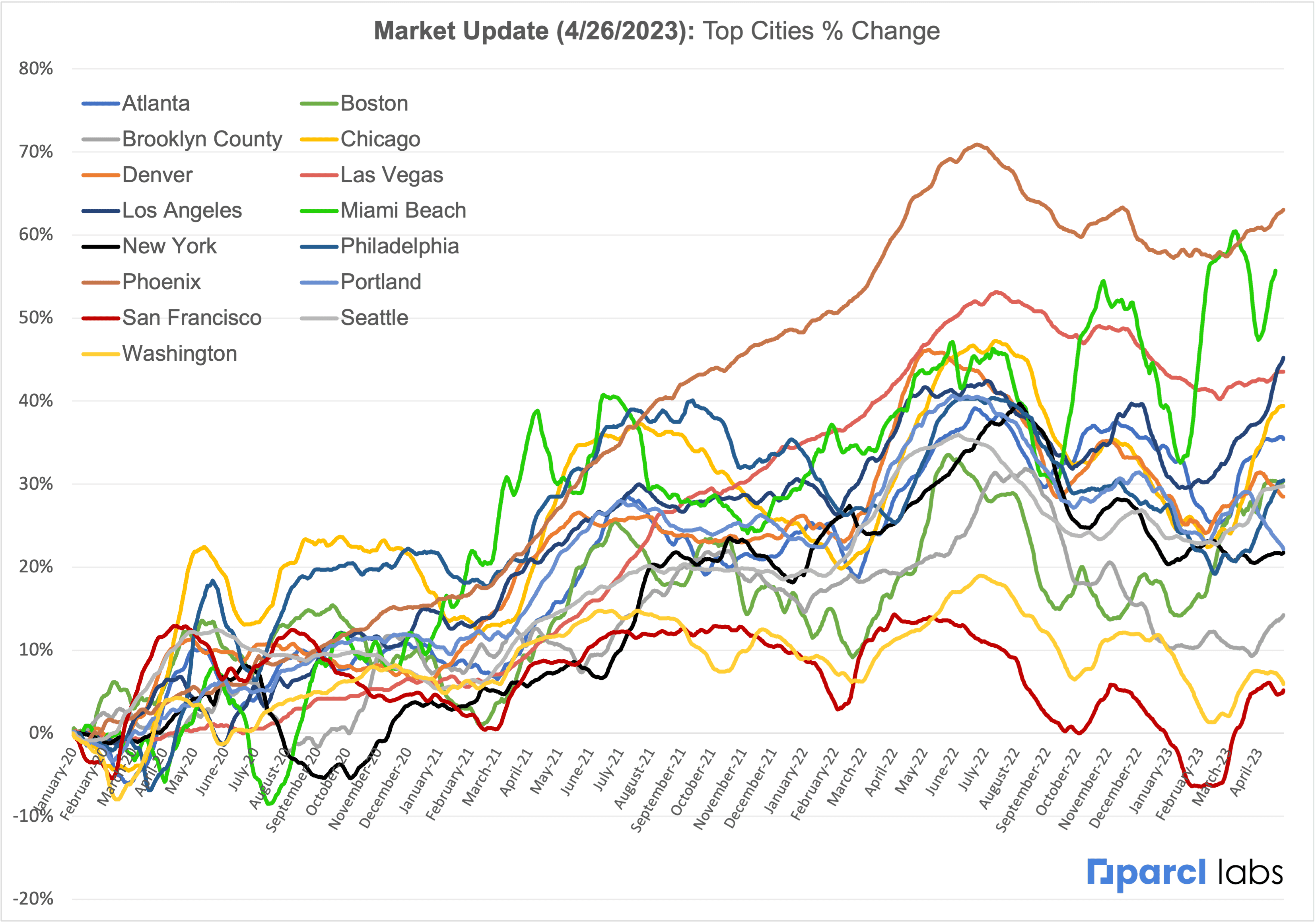

Residential real estate prices in the fifteen tradable Parcl markets continued to rise broadly week on week. These markets are now up an average of ~1.8% month to date (MTD) in April.

Some markets - such as Miami Beach, Los Angeles, Philadelphia, and Brooklyn - rose at a more significant pace week over week.

Washington D.C., Portland, and Denver lagged week over week; all remain down MTD.

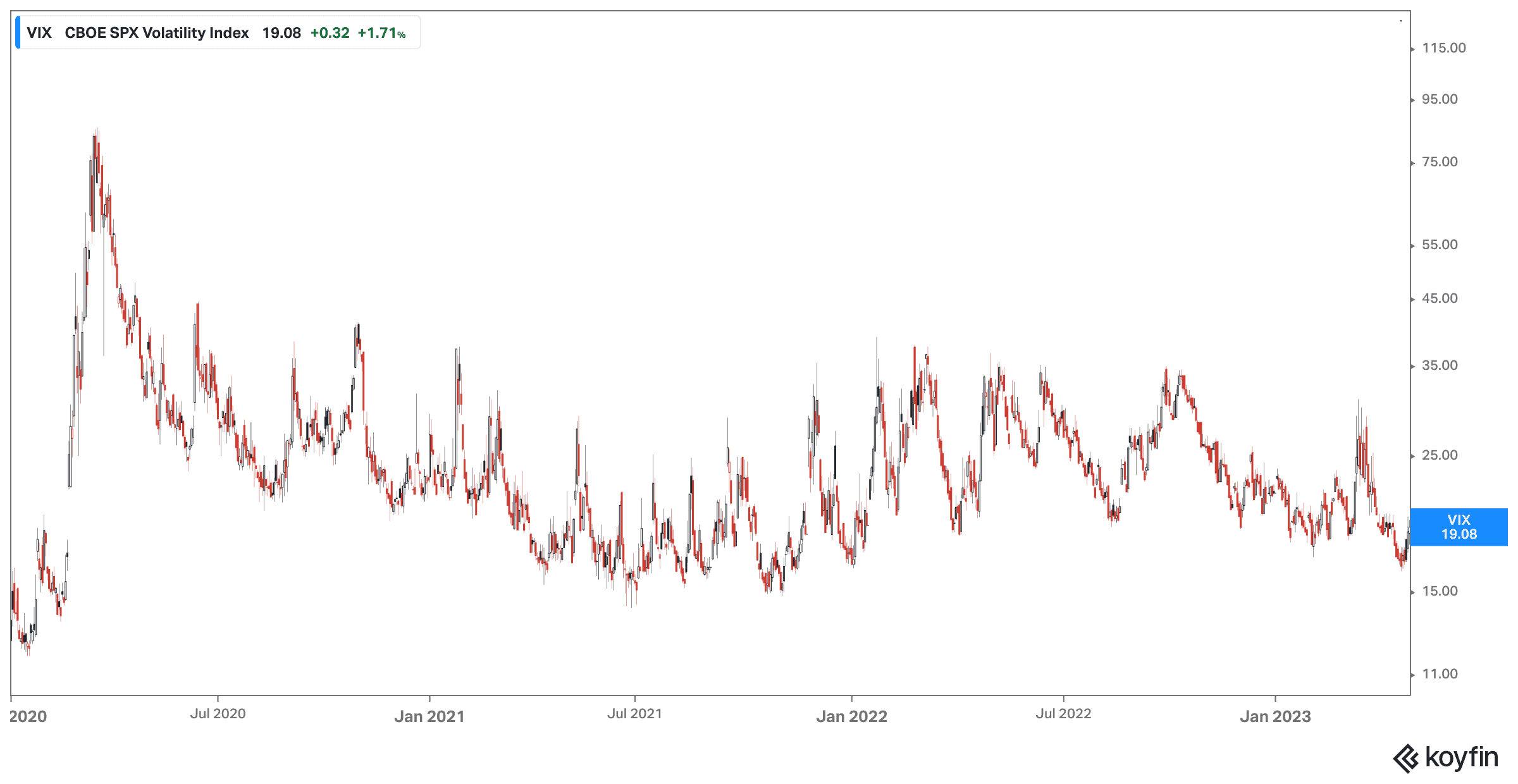

Volatility across markets & asset classes remains subdued following a recent spike around bank solvency concerns.

The spread between 30 year mortgage rates and the 10 year U.S. Treasury yield remains historically wide, though it ticked down slightly week over week.

Parcl traders continue to generally skew long. Only two of fifteen Parcl markets currently skew meaningfully short: San Francisco and Los Angeles (currently at all time high median ppsft).

Eight new Parcl markets launched for trading this week; Atlanta, Philadelphia, Seattle, Portland, Washington D.C., Denver, Chicago, and Boston.

The state of real time real estate prices

Residential real estate prices have broadly risen month to date (MTD) in April, with the 15 tradable Parcl markets covered in this update now up 1.8% MTD, on average. This compares to +1.5% MTD in the prior update (4/18).

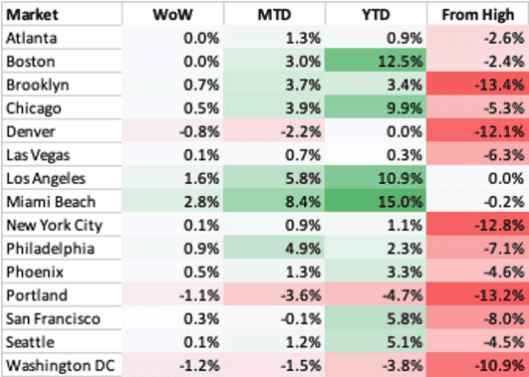

Some markets - such as Miami Beach (+8.4% MTD, +15.0% YTD, down 0.2% from peak), Los Angeles (+5.8%, +10.9%, all time high), and Philadelphia (+4.9%, +2.3%, -7.1%) - have risen at a more significant pace. Laggards are Washington D.C. (-1.5%, -3.8%, -10.9%), Portland (-3.6%, -4.7%, -13.2%), and Denver (-2.2%, +0.0%, -12.1%); all are down MTD.

This is a continuation of the trend of regional divergence that has persisted for much of the past ~12 months, at all levels of geography (national regions, state vs. state, intra-metro, etc.)

The Los Angeles market reached another all time high in median price per square foot this week. Miami Beach, the top performing Parcl market YTD, is within 20 basis points of its all time high.

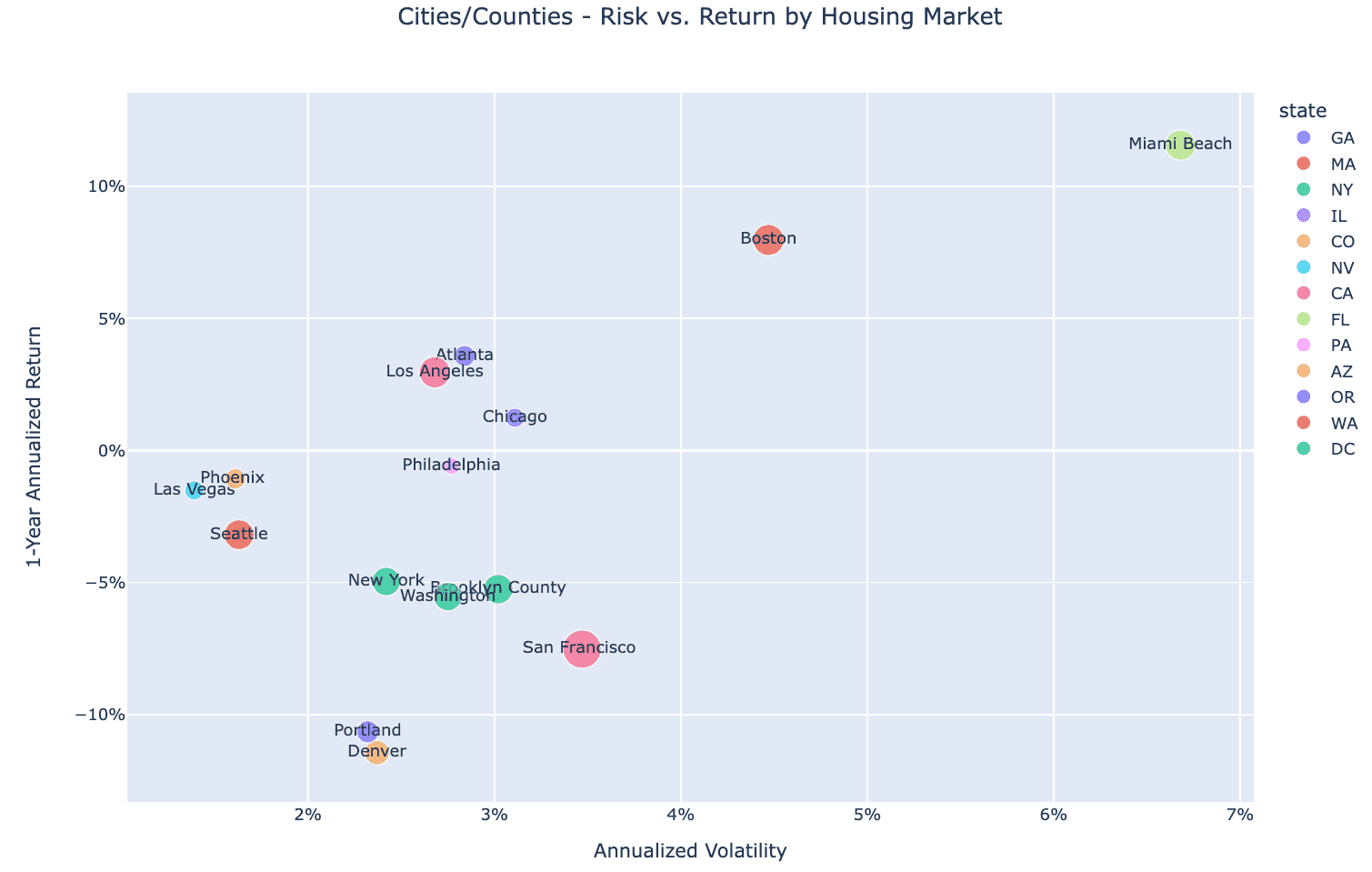

Miami and Boston continue to screen as top performers on a risk-adjusted basis. Portland, Denver, and San Francisco screen as the worst performers.

What factors are driving markets generally?

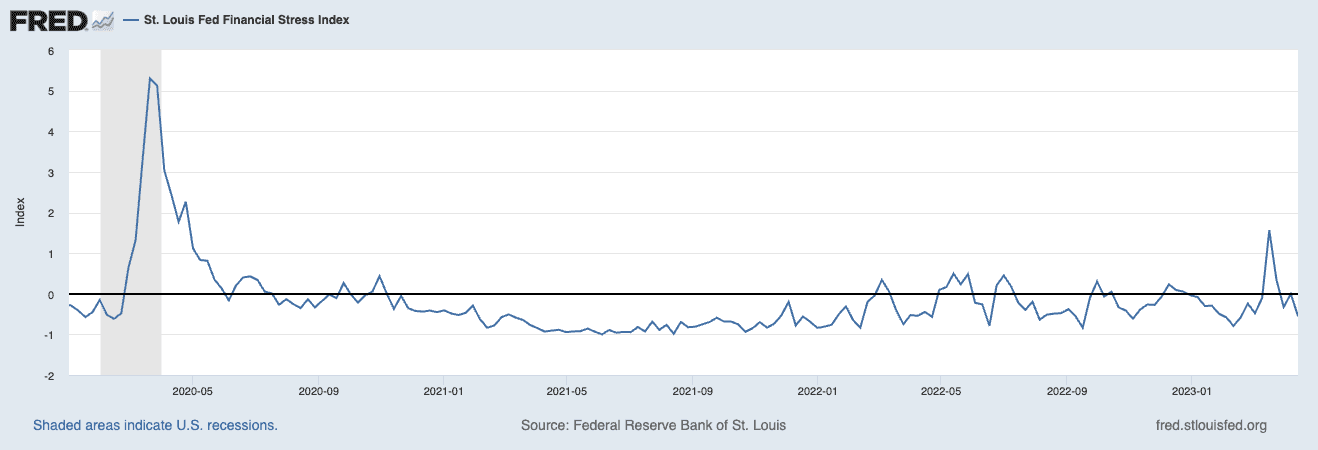

Volatility across markets remains relatively subdued, though up slightly week over week, after a spike in March around bank solvency concerns as evidenced by the VIX Index and St. Louis Fed Financial Stress Index (shown below). This has led to a stabilization in risk appetite, though both treasury yields and equity markets remain approximately flat MTD.

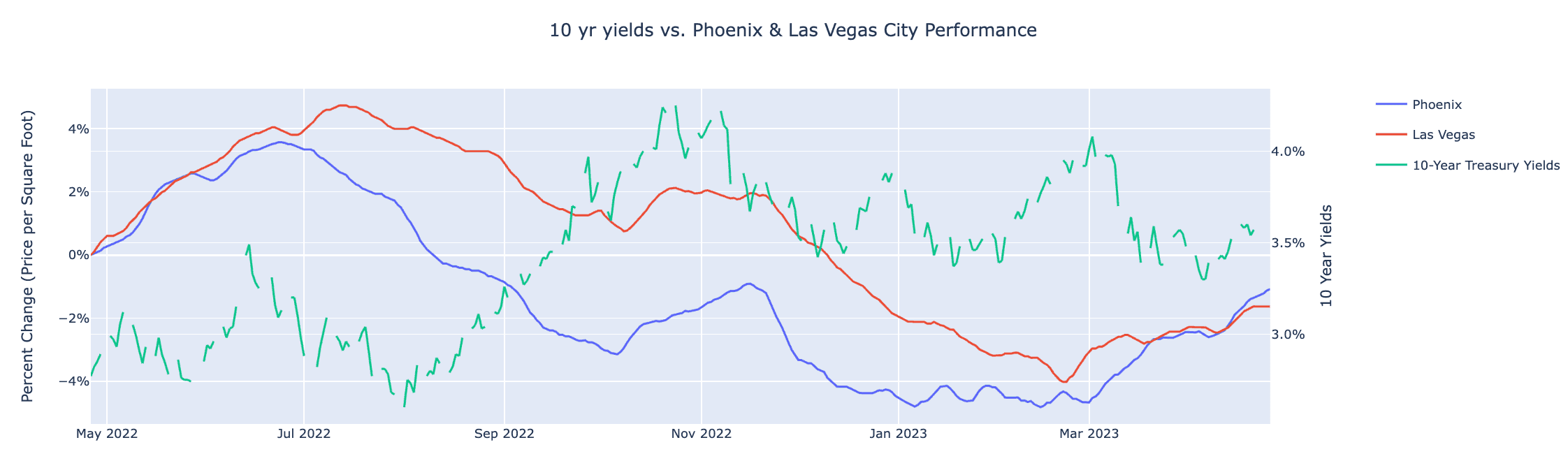

On the other hand treasury yields continue to exhibit elevated realized volatility, which has an impact on myriad downstream elements, such as mortgage rates and demand for housing. Phoenix and Las Vegas are two regional US real estate markets that exhibit among the highest negative correlations to real time changes in interest rates.

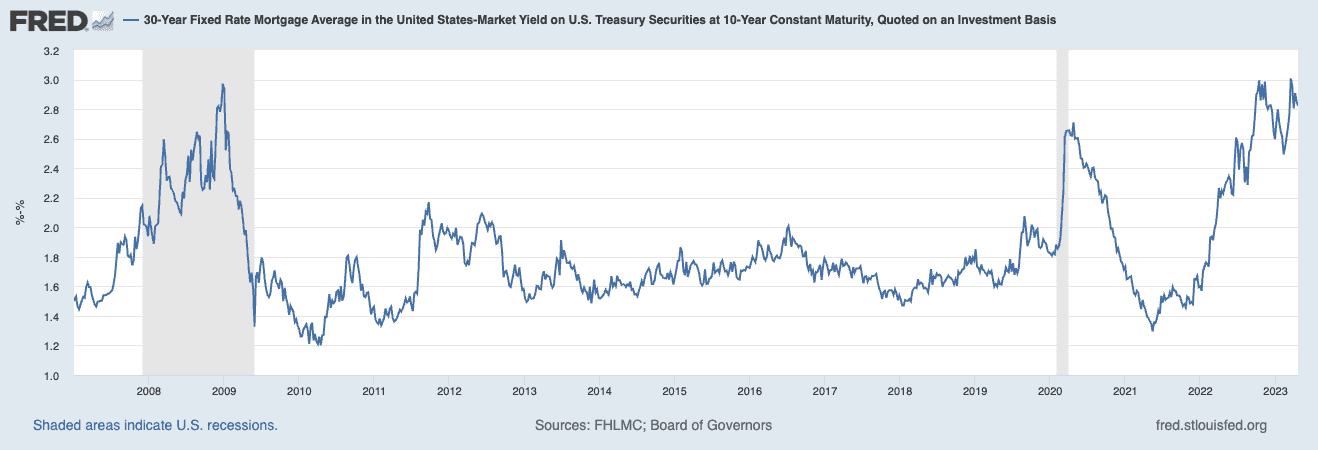

The spread between 30 year mortgage rates and the 10 year U.S. Treasury yield remains historically wide, though slightly lower week over week. Should this spread mean revert somewhat, and the 10y Treasury remains unchanged or continues to decline, this could perhaps create an additional tailwind for residential real estate demand near term.

The Case Shiller updated with February data on Tuesday, which showed a modest but broad recovery in prices across most markets. Real time data from Parcl Labs picked this up as it was happening, and, in the nearly two months since, show a strong recovery, with many markets up low/mid single digit percent from their end-February marks.

Parcl Team