Market Report: March 10th 2023

This covers the change in open interest and market sentiment in Parcl, as well as the state of real estate prices and what is driving markets generally. Parcl traders are expressing caution, but there may be opportunities to create pair trades and isolate idiosyncratic opportunities.

Parcl Team

Mar 10, 2023

What Parcl Traders Need to Know

Residential real estate prices are largely stable MTD, though the trend of regional divergence remains a key theme

Macroeconomic volatility is elevated; treasury yields are exhibiting elevated realized volatility, which has an impact on myriad downstream elements, such as mortgage rates and demand for housing

Idiosyncratic events such as banking contagion (SI, SIVB) and economic indicators such as NFP & CPI are occurring around the same time, exacerbating the push/pull on interest rates

Parcl traders may be expressing caution in the face of these events, but this also may create opportunities

The state of real time real estate

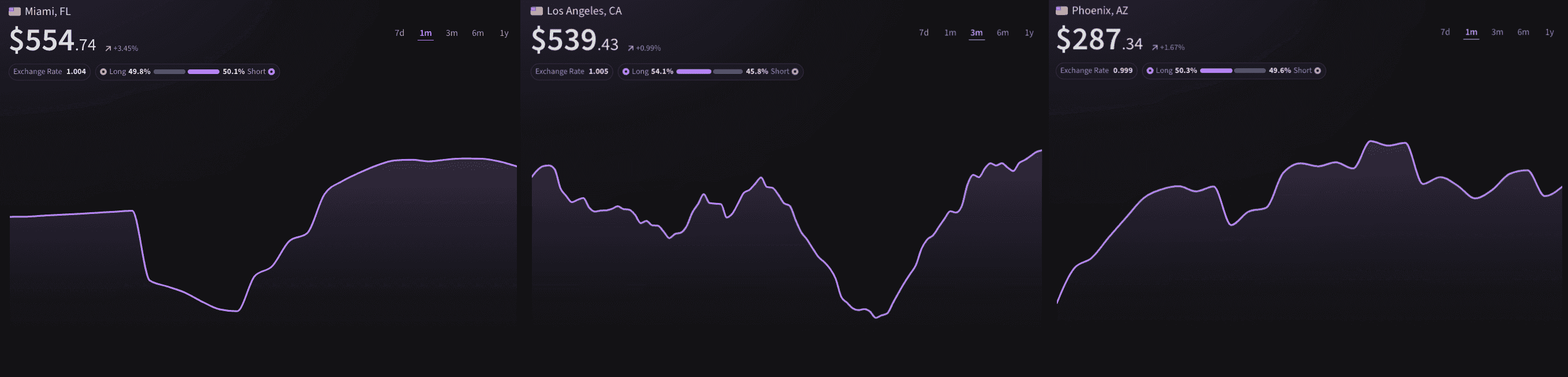

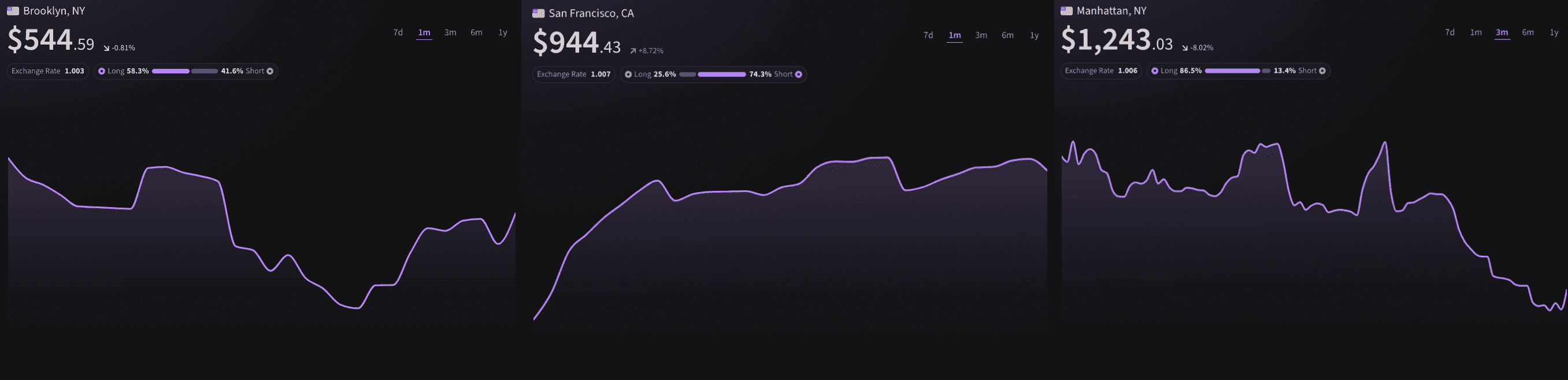

Residential real estate prices are largely stable MTD in March, though the trend of regional divergence remains a key theme. We see markets like Los Angeles and to a lesser degree Phoenix maintaining recent momentum. Markets like Miami and San Francisco may be forming a near-term topping pattern. Lastly, the New York boroughs of Manhattan and Brooklyn appear to be forming a near-term bottom.

What is driving markets generally?

Macroeconomic volatility remains elevated; treasury yields are moving ahead of typical annualized volatility, which has an impact on myriad downstream elements, such as mortgage rates and demand for housing. Recent events have led to a near term pullback in interest rates, which could provide some relief to homebuyers via lower mortgage rates. This could perhaps create demand resurgence near term.

Idiosyncratic events such as failures and contagion in parts of the banking system (SI, SIVB) and anticipation around economic indicators such as NFP & CPI are occurring around the same time, exacerbating the push/pull on interest rates and compounding changes in risk appetite.

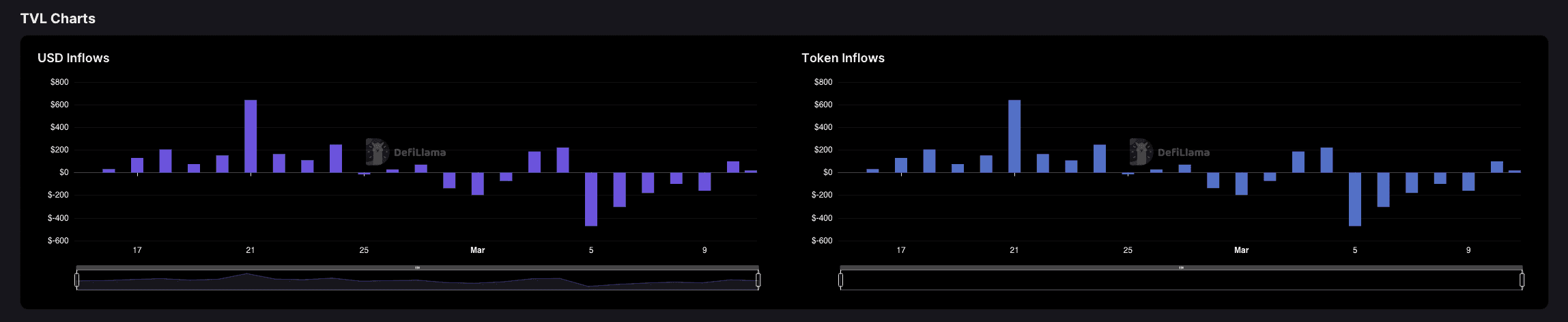

What are Parcl traders doing?

Parcl traders have been net position closers in recent sessions, though this trend is beginning to abate. We see opportunity to perhaps look for some opportunities to get long, particularly in beaten down markets like Manhattan, as interest rates pull back. In markets that have been particularly strong YTD, there may be opportunities to create pair trades & isolate idiosyncratic opportunities.

Parcl Team