Parcl Testnet 2.0 Is Live

Come test out the latest iteration of the Parcl protocol. We gathered your feedback and worked hard to make what you wanted into a reality. The main difference between the first and latest Testnet is the inclusion of concentrated liquidity.

Parcl Team

Aug 1, 2022

Welcome to Parcl Testnet 2.0!! The first Testnet took place from March 30th until April 10th. Our community left an abundance of feedback, and we read through all of it, and in the time since we have made many of the changes you wanted to see. Our team has grown significantly since then, and we’ve never been in better shape to bring real estate to everyone.

With Testnet 2.0, we invite our community, old and new, to stress-test and provide feedback on the latest version of the Parcl protocol, this time with new features.

Our latest and largest addition to our protocol is adding the ability to provide concentrated liquidity.

If you want to learn the basics of operating our Testnet, click here

What is Concentrated Liquidity?

In simple terms, providing concentrated liquidity refers to the ability of liquidity providers (LPs) to customize the price range in which they provide liquidity.

Essentially, it’s a way to make your money work more efficiently and maximizes any gains while reducing the risk of asset devaluation. The tighter the range you set for the concentrated liquidity, the higher the fee revenue that you’ll earn.

A Guide To Providing Concentrated Liquidity On Parcl

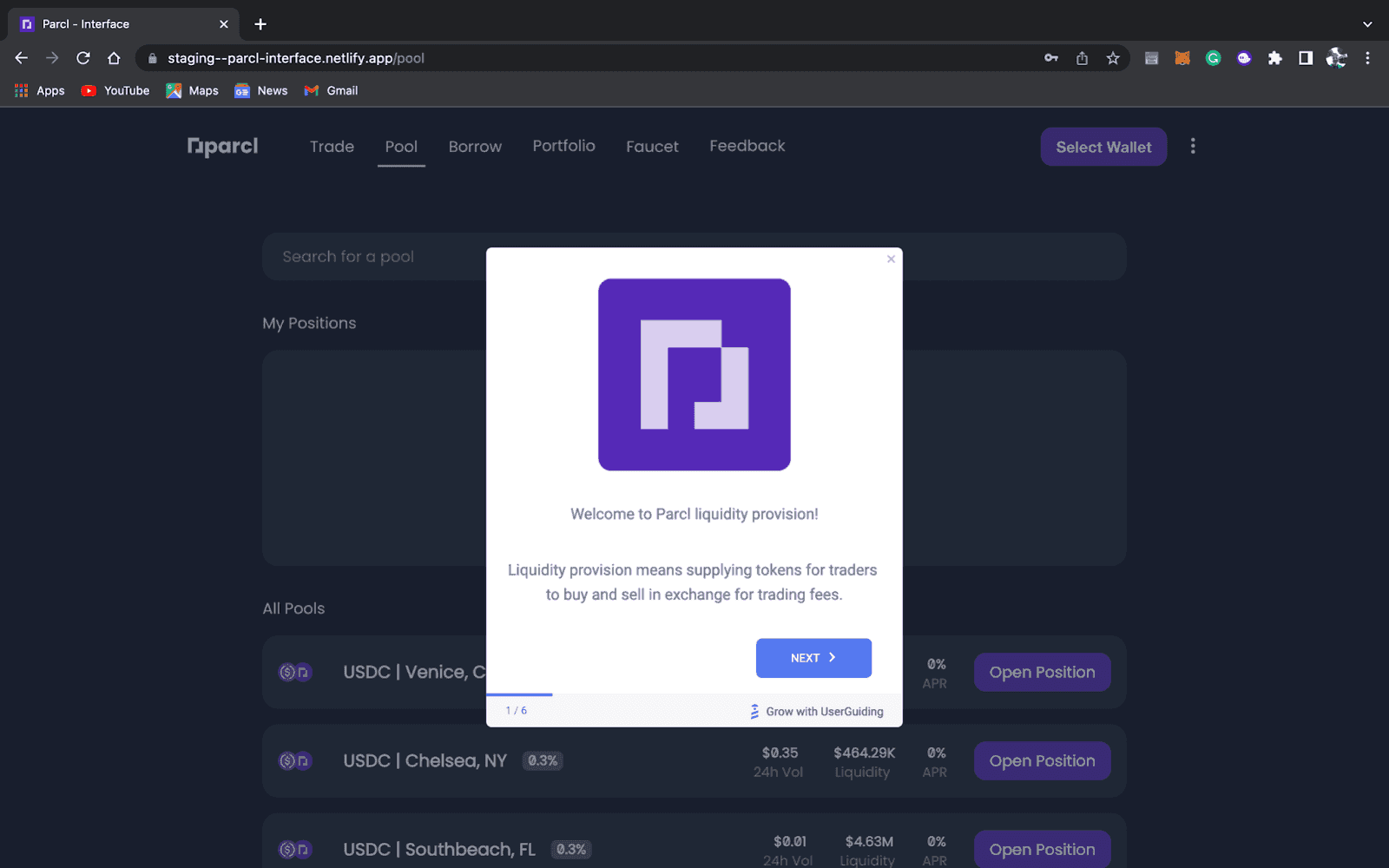

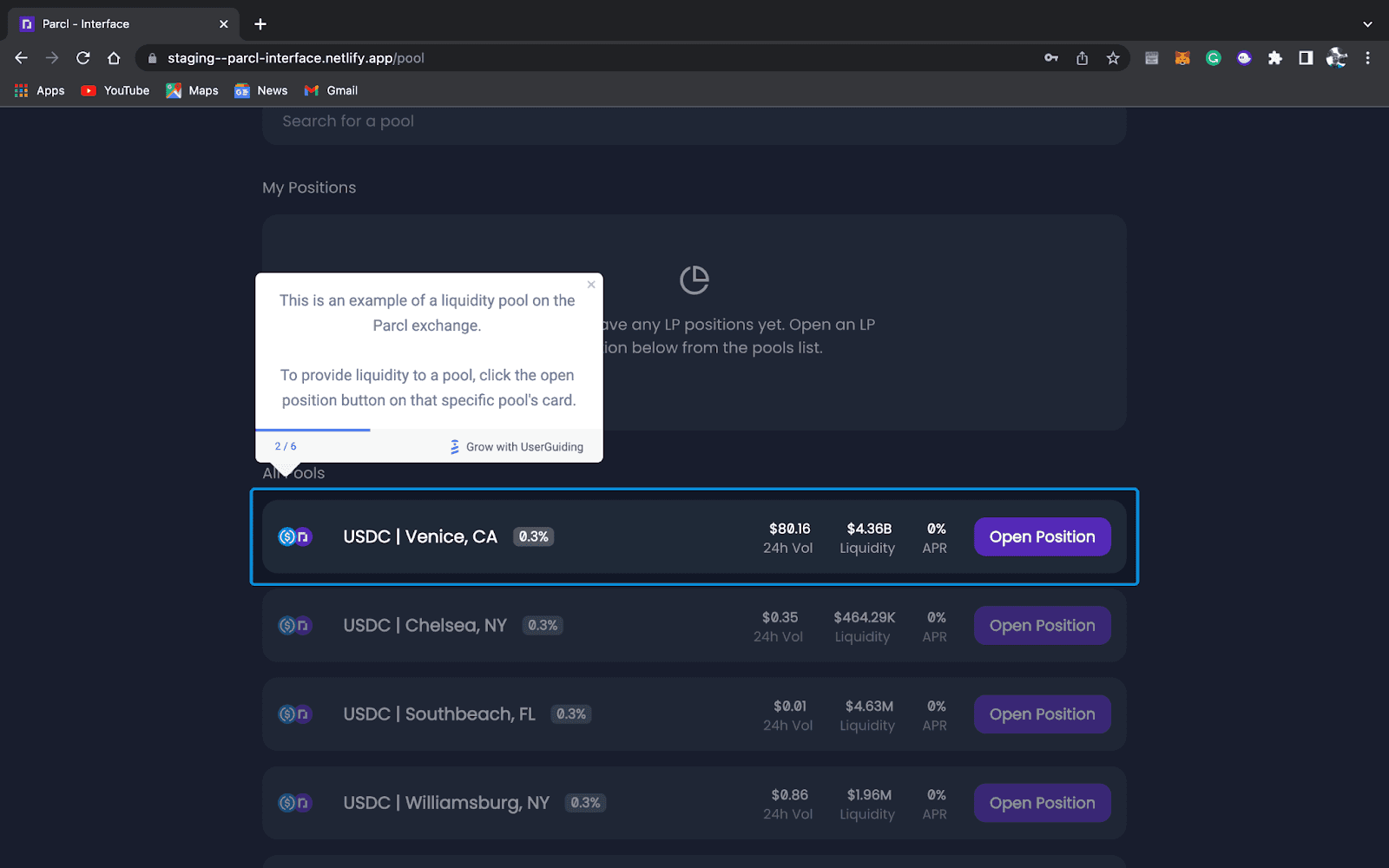

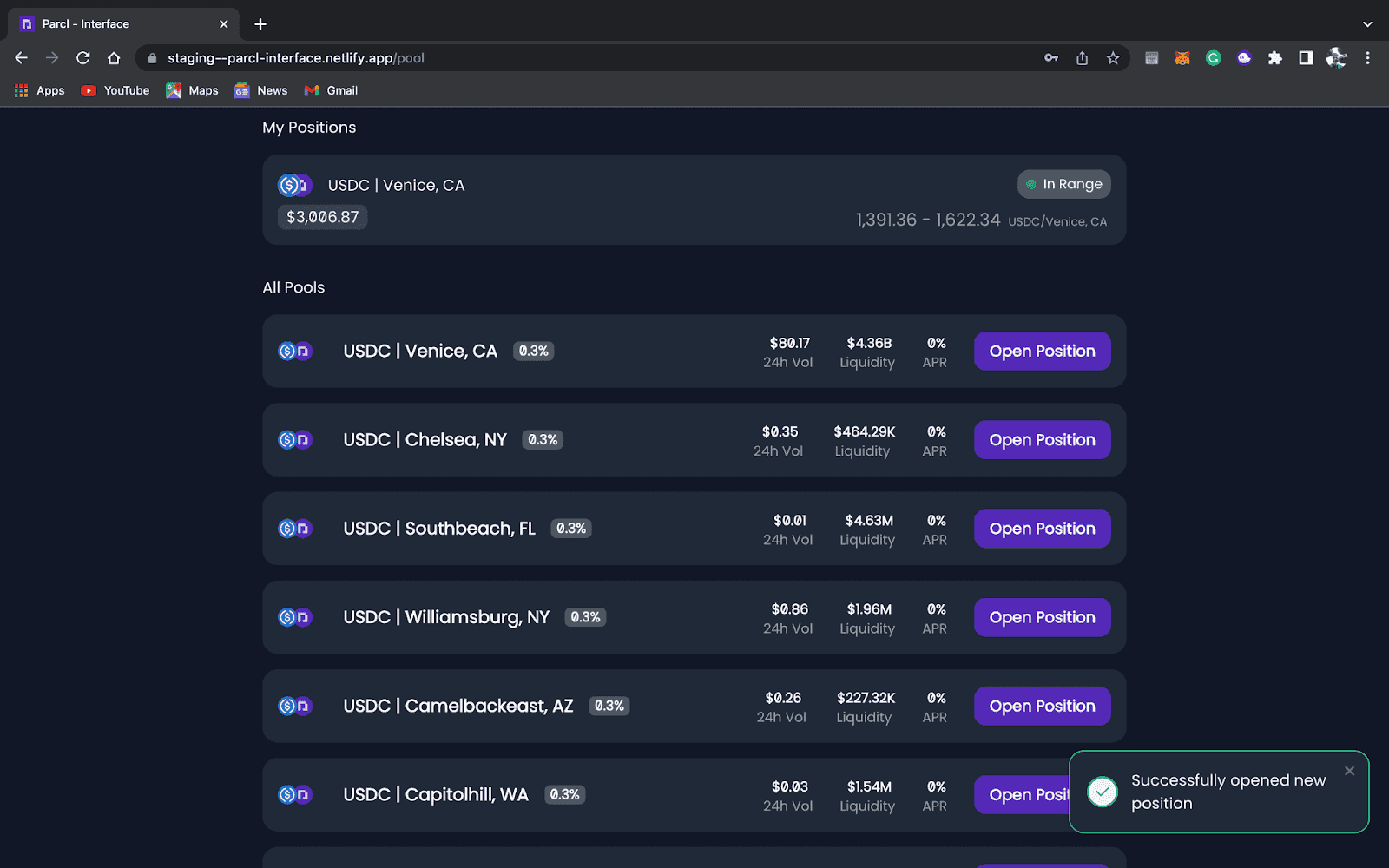

Begin by heading to Parcl.co and selecting which location pool you’d like to provide liquidity to. In this example we’ll use Venice, CA.

Simply click the button “Open Position” and it’ll take you to the next screen in which you can choose which liquidity strategy you’d like to go with.

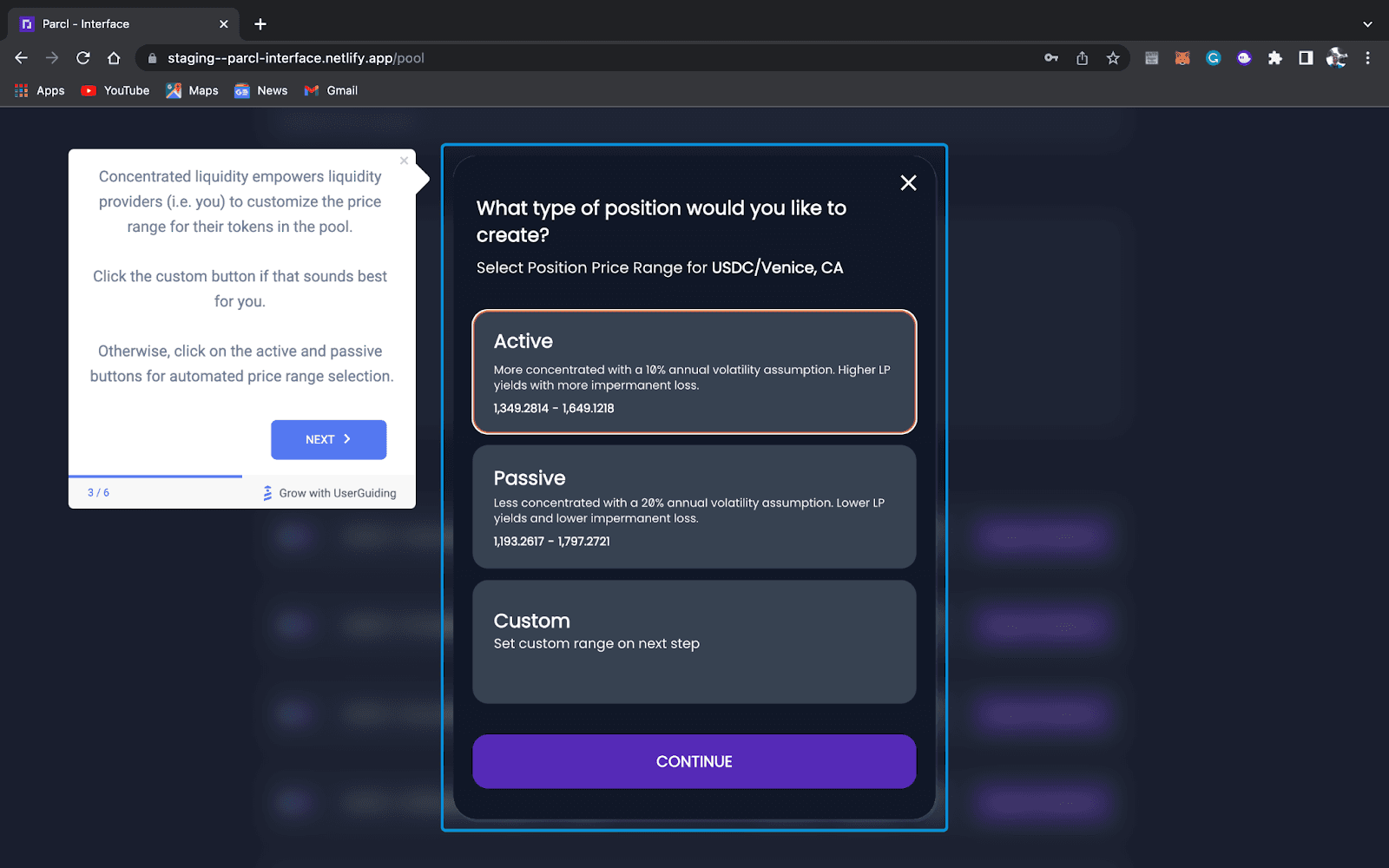

You have three options to choose from, active, passive or custom, which allows you to customize the price ranges in which you are comfortable investing your capital. For this example, we’re going to select custom.

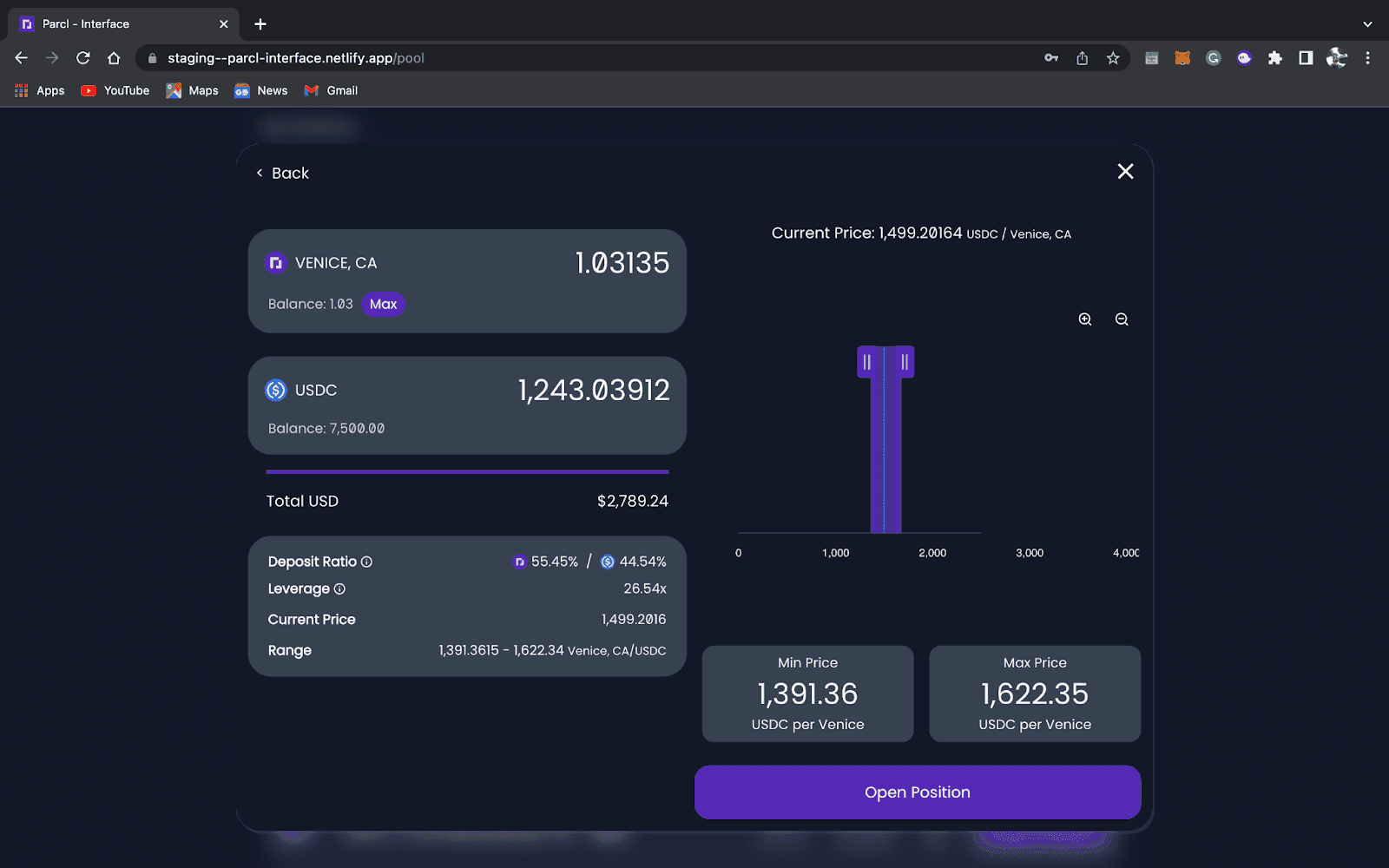

You then simply drag and drop the sliders on the liquidity price graph on the right hand side to your desired areas and click “Open Position”.

Congratulations you have now successfully provided concentrated liquidity!

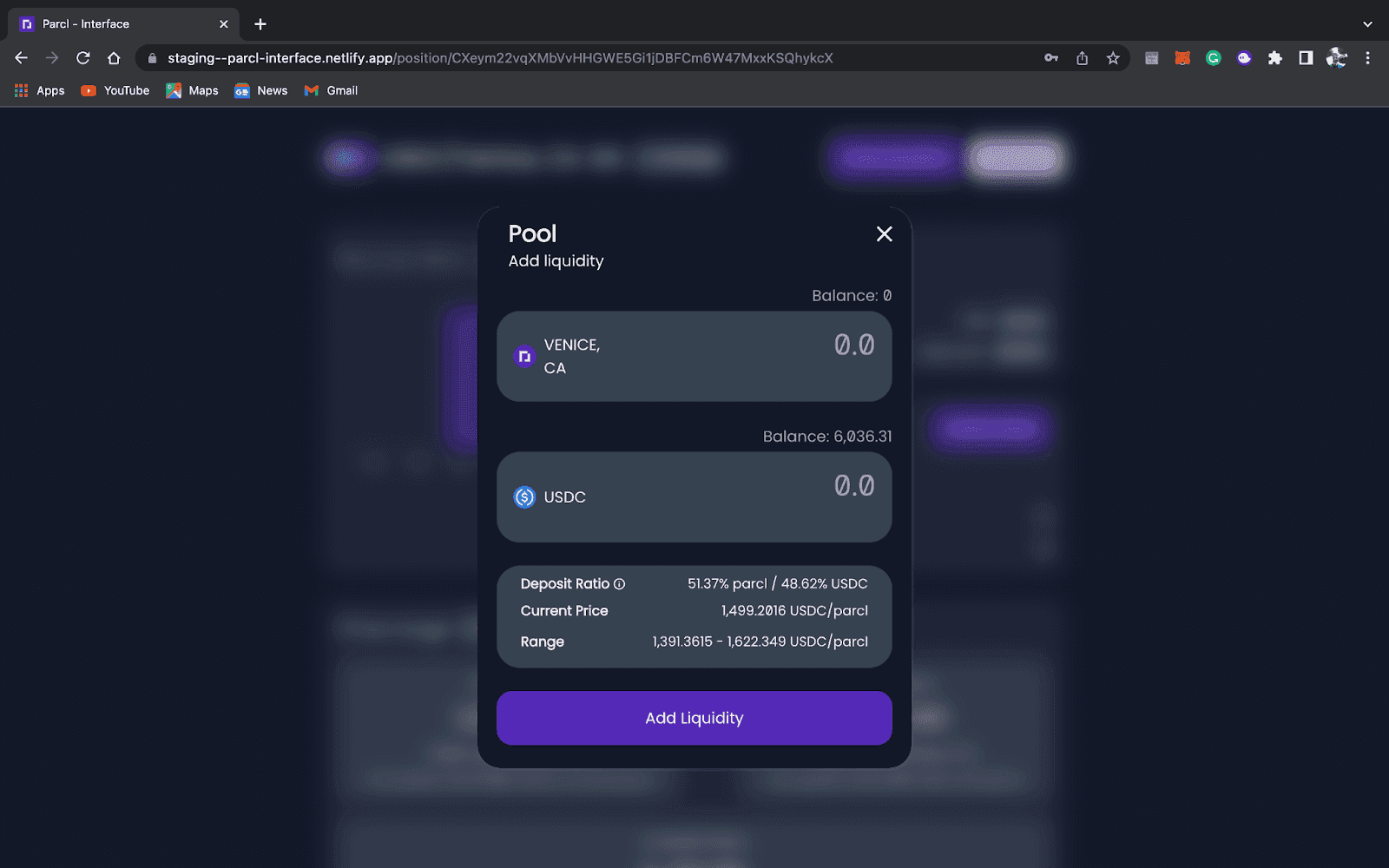

You can also provide additional liquidity to your already open liquidity positions.

What is Parcl?

Parcl is a seed-funded synthetic asset protocol that is on a mission to deliver real estate to everyone. The protocol allows for the creation of “Parcls” - smart contracts that are representative of the average price per square foot of real estate in a given geographical area.

Through Parcl, users can trade their favorite neighborhoods just like they would trade Bitcoin, Ethereum, or other crypto assets. By creating a derivative platform for individuals (or institutions) to execute peer-to-contract trades, Parcl makes real estate investing faster, cheaper, and more liquid than ever before. Learn more

If you want to learn how to operate our Testnet, you can check out our first Testnet announcement article, it’ll walk you through the basics.

Or check out our handy video guide here:

Make sure to skip to 0:40 as the competition was only valid for the first Testnet.

Shared content and posted charts are intended to be used for informational and educational purposes only. Parcl does not offer, and this information shall not be understood or construed as, financial advice or investment recommendations. The information provided is not a substitute for advice from an investment professional. Parcl does not accept liability for any financial loss or damages. For more information please see the terms of use.

Parcl Team