Why real estate is a great alternative investment

For investors, being diversified dampens the overall volatility of a portfolio by reducing macroeconomic, factor, and assets specific risks and thus providing investors with smoother return profiles.

Parcl Team

Dec 1, 2022

2022 has been a year of volatility for most asset classes. This is especially true of crypto, with most tokens down over 50% from their highs, and some down as much as 90% (or more).

For investors large and small, a tried and true method to reduce portfolio volatility is to increase portfolio diversification. Alternative investments, such as real estate, are widely recognized as excellent portfolio diversification tools.

For the first time ever, crypto investors can trade real estate markets in real time, via Parcl and the Parcl Protocol, with no minimum investment, high liquidity, and low transaction fees.

Crypto volatility and price declines highlight the need for diversification.

Extraordinary levels of volatility have plagued most asset classes in 2022, including crypto markets. As it pertains to crypto, the drivers are both macroeconomic in nature (inflation, rising interest rates), and sector-specific (Centralized Exchange failures, massive deleveraging).

For investors, being diversified dampens the overall volatility of a portfolio by reducing macroeconomic, factor, and assets specific risks and thus providing investors with smoother return profiles.

Real estate is one of the best alternative investment options and an excellent portfolio diversifier.

Real estate is the world’s largest asset class, and, for many, real estate is the best traveled path towards financial independence. Billionaire Andrew Carnegie famously said that ”90% of millionaires got their wealth by investing in real estate”.

When prices of stocks, bonds, and crypto begin to decline, real estate doesn’t necessarily drop with them, thanks to real estate’s low correlation with other asset markets.

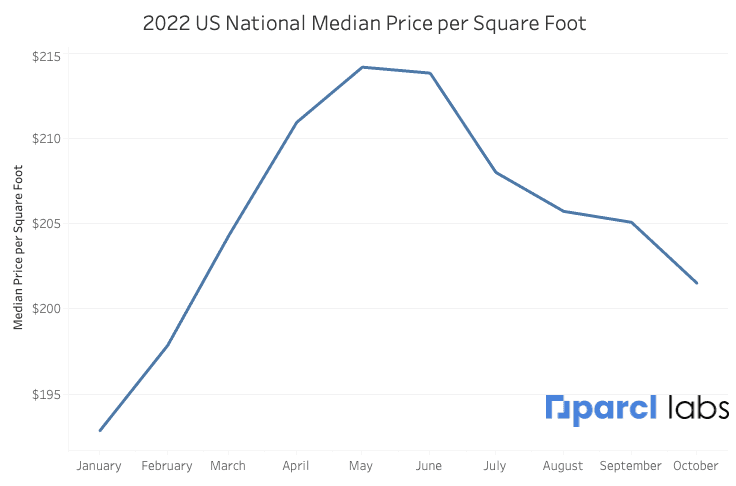

Real estate peaked in mid 2022, but its volatility has been far lower than other assets

Diversifying a portfolio by investing in real estate can help to minimize risk and (potentially) improve returns. It can also generate passive income and improve the overall capital appreciation of a portfolio.

Real estate is the world’s largest asset class, yet it is illiquid, with high barriers to entry.

Traditional real estate investing is just like most TradFi institutions; it favors those with resources. High down payments and investment minimums, illiquid resale markets, accreditation requirements, and long minimum hold times all make it nearly impossible for modern investors to participate in the real estate market - directly or indirectly.

At the same time, there remains immense demand from investors, large and small, to gain access to real estate returns. Billions of people across the world have been priced out of owning property and gaining exposure to this multi-trillion dollar market.

That was before Parcl.

The Parcl Protocol makes it possible to gain real-time, liquid exposure to real world real estate prices and earn passive income.

Parcl delivers accurate, real-time real estate data and leverages blockchain technology to develop a liquid real estate derivatives platform that allows users to gain price exposure to global real estate markets.

The Parcl Protocol is an essential venue for accessing real-time liquidity within the residential real estate market. Users can hedge, trade, speculate, and invest in the prices of the most recognizable real estate markets worldwide.

Modern investors deserve modern solutions. Thanks to blockchain & crypto, a contemporary solution now exists for investors looking to diversify their portfolios with the most recognizable asset class in the world: real estate.

Shared content and posted charts are intended to be used for informational and educational purposes only. Parcl does not offer, and this information shall not be understood or construed as, financial advice or investment recommendations. The information provided is not a substitute for advice from an investment professional. Parcl does not accept liability for any financial loss or damages. For more information please see the terms of use.

Parcl Team