A Beginner's Guide to Cryptocurrency

With interest in crypto, the metaverse, and blockchain continuing to grow, it can be difficult to keep up. In this guide, we cover the fundamentals of Web3 and crypto.

Parcl Team

Aug 1, 2022

With interest in crypto, the metaverse, and blockchain continuing to grow, it can be difficult to keep up. In this guide, we cover the fundamentals of Web3 and crypto.

What Is cryptocurrency?

A cryptocurrency is a digital or virtual currency that is secured by cryptographic technology, which makes it nearly impossible to counterfeit or double-spend. There’s more to it of course, but cryptocurrency is essentially laying the foundation of digital currency in the modern world.

Cryptocurrency removes the reliance on banks to verify the transaction; it can be described as a peer-to-peer system, meaning that anyone or entity such as a government can send and receive payments without regulation or hindrance.

With every transaction that someone makes, it's recorded on a public ledger, otherwise known as the Blockchain.

The first cryptocurrency was Bitcoin, which was founded in 2009, off the back of the 2008 financial crisis. It was founded by Satoshi Nakamoto. To this day, Satoshi’s true identity hasn't yet been revealed. There’s speculation, Satoshi actually may be more than one person.

How does the blockchain work?

A blockchain collects information together in groups, known as blocks, which hold sets of information. Blocks have certain storage capacities and, when filled, are closed and linked to the previously filled block, forming a chain of data known as the Blockchain. Blockchain is the technology that underpins a cryptocurrency.

How many blockchains are there?

There are 4 main types of Blockchain:

1. Public blockchain

A public blockchain is what most people associate when they think of cryptocurrency as the most widely used.

Bitcoin, the most popular cryptocurrency, operates on top of a public blockchain, know as the Bitcoin blockchain. The aim of public blockchains is to promote Decentralization by removing the need for middlemen, offering greater transparency and better security.

Advantages

No single entity has control over the network

No one can alter information stored on the Ledger

They provide greater transparency and are relatively secure

Disadvantages

Public blockchains are slower at processing information and transaction

They have poor scalability opportunities

Hackers could theortically gain 51% control of the network by controlling nodes and altering it. This is incredibly difficult to do, but still possible

Use cases

Public blockchains are best when used to store records that the public may have an interest in, such as government spending, real estate verification, financial institution conduct, and charitable spending.

2. Private blockchain

Private blockchains are restrictive by design and are made to be closed off to the public. They're generally controlled by a single entity or individual. A good comparison would be like using the intranet, a private internet network used by companies to control and restrict certain content from employees.

Advantages

Node authority is decided by the individual entity

Third parties are restricted from accessing certain information

Due to the smaller scale, they're much faster at processing information

Disadvantages

Many disregard private blockchains as they're not truly decentralized

Not as trustworthy from a transparency perspective

Can be controlled by a single entity

Easier for hackers to gain control as they operate with fewer nodes

The source code can't be independently verified

Use cases

If a business needs information to be secure, private, and fast, a private blockchain would be ideal. Some examples of this could be to secure census records, medical records, and businesses that want to cryptographically secure trade secrets.

3. Hybrid blockchain

A hybrid blockchain combines features from both private and public Blockchain. Organizations will be allowed to set up a private, permission-based system alongside a public permissionless one.

A hybrid blockchain makes it possible for private yet verifiable transactions that cannot be altered by the organization.

Users can fully operate on a hybrid blockchain with anonymity until the point of transaction, with their identity then being revealed to the other party.

Advantages

Operates within a closed system, meaning less chance of being compromised

The information can still be shared and verified by third parties

Transactions of hybrid blockchains are typically cheaper, faster, and scalable

Disadvantages

Data can still be shielded from third parties; it's not fully transparent

Use cases

Real estate could be a good industry to use hybrid blockchain as it'll provide somewhere to store data while showing only necessary information. It could also streamline both the hospitality and the retail sector.

Any sector that deals with sensitive information but still wants to offer transparency through verification could benefit from this type of blockchain. Medical records are also another way a hybrid blockchain could be used.

4. Consortium blockchain

A consortium blockchain, also known as a federated blockchain, is similar to a hybrid blockchain but different in that the organization's employees work on a decentralized network.

In summary, it's a private blockchain but grants access to a particular group rather than a single entity, meaning less risk of an individual controlling the entire network.

In a consortium blockchain, the consensus procedures are controlled by preset nodes. It has a validator node that initiates, receives, and validates transactions. Member nodes can receive or initiate transactions.

Advantages

A great option for security, scalability, and efficiency when compared to a public ledger

It offers more control to individuals in comparison to a private and hybrid versions

Disadvantages

Less transparent than a public ledger

It can still be compromised if a member node is breached

The blockchains regulations can impair the network functionality

Use cases

Banking and payments are two uses for this type of blockchain. Different banks can band together and form a consortium, deciding which nodes will validate the transactions.

Research organizations can create a similar model, as can organizations that want to track supply resources. It's ideal for supply chains, particularly food and medicine applications.

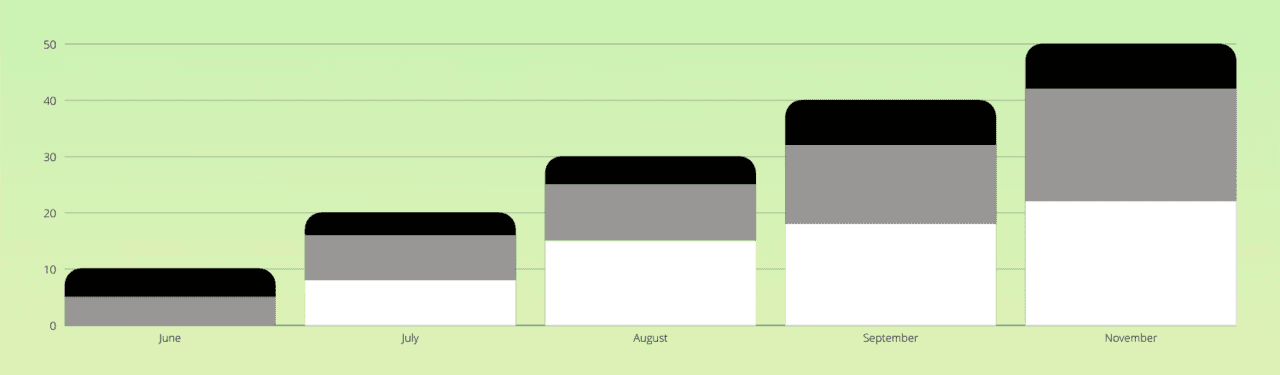

Cryptocurrency adoption

As of 2021, cryptocurrency ownership has been estimated to currently sit around 3.9% of the world's population, which is a splash in the ocean when compared to general internet usage, which is currently 62.5%.

Three hundred million people currently own or use cryptocurrency on a daily basis, with around 18,000 businesses using it as a method of payment.

Interestingly, the country with the most crypto users is India, with 100 million users. This is no surprise given the country's recent 'black money’ issues as well as rising inflation.

You can check out detailed information on cryptocurrency usage by country to understand more about adoption.

It's also interesting to note that these numbers are only increasing across the world; many analysts predict that people will be using crypto to the same extent as they currently use the internet within the next 20 years.

Another area of Web3 that has propelled cryptocurrency usage is the increasing popularity of the Metaverse and Digital Real Estate ecosystem.

Where can you buy cryptocurrency?

Buying cryptocurrency has continued to become easier overtime, thanks to the hundreds of crypto companies making it more accessible. What was once a complicated process has turned into a somewhat user-friendly experience depending on the method and platform you use to buy your crypto.

The main and safest way to buy your first cryptocurrency is to purchase it from an exchange, there are thousands of cryptocurrency exchanges out there, but the most trustworthy include:

Coinbase

Coinbase should be any beginner's go-to cryptocurrency exchange. It offers a large number of supported cryptocurrencies with one of the highest levels of security. If you're into more advanced forms of trading, you can utilize their Coinbase Pro platform, mainly used by professional traders.

Binance

Binance has one of the largest collections of supported cryptocurrency pairs out of any other exchange; it's also one of the most widely used by intermediate-level beginners. One of the greatest benefits of using Binance is that they have some of the lowest exchange fees.

Gemini

Gemini is one of the only cryptocurrency exchanges to put an emphasis on being compliant and secure from its conception. Founded by the Winklevoss twins, the exchange has some of the most robust security protocols in the world of crypto, along with being SOC-2 certified.

Gemini also insures all of its users' assets; just in case of a security breach, these extra security levels are what make Gemini the most trusted cryptocurrency exchange in the world.

The best crypto wallets

When you set up your crypto wallet, you'll generate a public key and a private key, both of these together are known as a keypair.

The public key (pubkey) is used by other people to send you cryptocurrency. The public key can also be used to see the balance of that particular wallet.

The private key is your digital signature, and this is used with every transaction or change to the wallet.

It’s critical to remember, that you should never, ever, share your private key with anyone; if someone knows your private key, they'll be able to access your wallet.

Which wallets can you trust? Let’s take a look.

Phantom

With the increasing popularity of the Solana network and Solana NFTs, Phantom has quickly become a huge favorite of the crypto community due to its fast and easy-to-use application.

It offers various staking options and incredibly fast swaps and has recently released its iOS App, which previously only offered an Android App.

MetaMask

Launched back in 2016, Metamask is certainly one of the most used cryptocurrency wallets, mainly due to beginners' advantage. It was built for users to hold Ethereum and interact with other projects on the Ethereum blockchain.

Ledger

Ledger, a hardware wallet, is the industry leader in cryptocurrency wallet security; they've built a great reputation for being the most secure wallet provider on the market and have several products to offer users.

If you're holding crypto worth over a few thousand dollars, Ledger would certainly be the way to go. Especially when the value of your digital real estate increases, you'll need the safest place to store it. Ledger is a more expensive option but certainly worth it for security reasons.

What Is digital real estate?

Digital real estate was previously known to include social media accounts, URLs, and websites. Now, digital real estate has been given a whole new meaning.

Digital real estate is now considered an ecosystem of protocols, tools, and projects that collectively work to make real estate transactions cheaper, faster, and more accessible to the average person.

This environment includes projects such as Parcl, Propy, Lofty, Decentraland, Sandbox, and many more, including many Web2 proptech companies.

Digital real estate investing isn't just buying land in the Metaverse; it's also about taking advantage of the opportunities that Web3 provides by making investing in real estate accessible, financially and logistically, thanks to new technology.

Millions of Americans and others across the globe are priced out of an asset class that has outperformed most others, including stocks, commodities, and many more. It's time to level the playing field and make investing in real estate possible for the average person.

Digital real estate investing can quickly become a lucrative side hustle; there are currently a few ways to do it:

Buying and selling metaverse real estate

The most obvious way is to buy and sell digital land on platforms such as Decentraland and Sandbox. You can buy directly from them or a 3rd party marketplace like OpenSea or Rarible.

The downside to this is that, as popularity grows, prices for land will increase, making it inaccessible for a majority of people. It's also not guaranteed that you'll sell any of your digital lands.

Renting metaverse land

The most popular way to do this isn't by doing it alone but as a metaverse fractional ownership agreement via a DAO.

Using the platform - LandWorks - you can rent out your Decentraland real estate, and in return, you'll receive payments in their native token, ENTR.

Tokenized fractional ownership

Tokenized Fractional Ownership is a popular way to invest in assets in a cheaper and more manageable way. Tokenization has the potential to provide market access to people currently priced out of real estate investing by making it more affordable.

When you invest in a tokenized property, you'll be rewarded daily or weekly with a portion of rental payments in proportion to your initial investment. This payment is usually made in stablecoins or the platform's native currency.

Synthetic real estate trading

Parcl uses synthetic assets to allow investors to invest in real estate like they would with Bitcoin, Ethereum, or Solana. You'll be able to invest in areas such as Manhattan, Soho, Tribeca, and many more with the click of a button.

The latest addition to the digital real estate space is the ability to trade real estate that exists in the real world like you'd trade Bitcoin, Ethereum, or Solana. Parcl is currently the only project offering this innovative method of property investing.

The Metaverse

The Metaverse consists of seven layers and, overall, has seen a huge influx of attention since the announcement of Meta's (formerly Facebook) plans to invest in building out its own digital universe. The company has invested $50 million and is currently working to employ 10,000 new "meta-mates" to build and manage the project.

The seven layers of the Metaverse include:

1. Experience

This level is the most known, and many within the Web3 community are invested in projects situated in this phase. Applications, games, and shopping experiences such as marketplaces, NFTs, e-sports, and other events are all ways in which users interact with a digital environment.

2. Discovery

This layer refers to how users will find out about new experiences or platforms, including app stores, search engines, rating sites, or even display advertising.

This is an important step in discovering new technology, protocols, and communities.

3. The creator economy

This includes the many design tools and apps that developers and designers use to create digital assets or experiences.

As time goes on, many platforms are building easier creator solutions like drag and drop tools. Think of it like a codeless website builder but for digital assets in the Metaverse.

4. Spatial computing

AR, VR, and XR all fit into this layer. Projects in this phase aim to make these digital experiences as immersive and realistic as possible.

There are rumors of Google having the desire to begin mapping the Metaverse.

5. Decentralization

You can't build the Metaverse without key components of Decentralization such as the Blockchain, smart contracts, open-source code, and what people call self-sovereign digital identity.

6. Human Interface

VR headsets, smart glasses, and soon haptic technology will allow your body to transport itself to a digital world.

7. Infrastructure

The backend of the Metaverse keeps everything running smoothly. This layer includes things like the power grid, networks, WIFI capabilities, 5G and 6G networks, cloud computing services, and advanced GPU technology all fall into this layer.

What Is An NFT?

NFT stands for "Non-fungible token," which essentially means that it's one of a kind and cannot be replicated. It's a digital identification or certificate which is registered on a blockchain and used as a record of ownership of an asset.

NFTs have been around since 2014 but have just recently gained popularity. Over the period of one year, NFTs have hit $17 billion in trade volume, an increase of 21,000%.

An NFT generally has a permanent and tamper-proof authentication built into its code which makes ownership of the NFT easier to verify.

How NFTs can change the world of real estate investing

There are dozens of ways NFTs can be used to boost the real estate industry. The most obvious for many would be to use NFTs as a way to verify ownership and reduce the likelihood of real estate or mortgage fraud.

As NFTs are unique, you can include many of the documentation of the properties inside these NFTs, and rather than taking months for deals to close, it can be done in a matter of seconds using smart contracts, NFTs, and a centralized platform.

In fact, Propy is currently doing just that. They recently sold a real estate NFT situated in Tampa for $600,000. They're looking to continue and are always looking for more houses to list as NFTs.

Using NFTs to verify ownership and authenticate documents will save millions of dollars from being lost to lengthy processes and smart fraudsters, which costs around $200 million per year.

You can use NFTs to make rental property investment cheaper and mortgages easier and faster to secure.

Conclusion

And there you have it, an in-depth primer into the world of cryptocurrency. We’ll continue to upload this guide to stay up to date with everything crypto, digital real estate, and blockchain tech.

Shared content and posted charts are intended to be used for informational and educational purposes only. Parcl does not offer, and this information shall not be understood or construed as, financial advice or investment recommendations. The information provided is not a substitute for advice from an investment professional. Parcl does not accept liability for any financial loss or damages. For more information please see the terms of use.

Parcl Team