5 tax benefits of investing in real estate

Real estate investing is an incredibly popular way to diversify your investment portfolio. But did you know these 5 tax benefits? Learn more now.

Parcl Team

Aug 17, 2022

Every savvy investor knows that diversification is important for long-term capital growth and most importantly portfolio preservation. While there are many ways to diversify your investing your portfolio, real estate remains one of the most popular options given its many advantages.

Real estate is one of those asset classes that everyone dreams of having exposure to, mainly for the recurring cash flow and relatively strong and consistent returns it has historically provided.

But beyond being able to make money in real estate, real estate investing offers additional benefits in the form of tax advantages.

In this article, we’ll look at five tax benefits and opportunities of investing in real estate which can be incredibly useful for any current or up and coming real estate investor. Not every benefit will be applicable to every real estate investor's situation, but they can be helpful for those looking to make their real estate investments go further!

Tax benefits of investing in real estate

1.) Pass-through deductions

A pass-through dedication allows an individual to deduct up to 20% of one’s rental income (if qualified) on your income taxes. If you’re the sole proprietor of a rental property via a partnership, LLC or an S Corp, the money you collect is generally considered a qualified business income according to real estate tax law. At scale, this tax benefit can really add up!

2.) Depreciation tax deductions

The depreciation deduction as it pertains to real estate, allows investors to recover the cost of income-producing property through yearly tax deductions. Essentially, the IRS provides you with an allowance for wear and tear of a property. The three factors which determine the amount of depreciation someone can deduct includes:

The value of the property;

The property recovery period;

The depreciation method used.

The method investors typically use is called the Modified Accelerated Cost Recovery System or MARCS. This allows investors to deduct depreciation on a piece of residential property for 27.5 years and 39 years for commercial property.

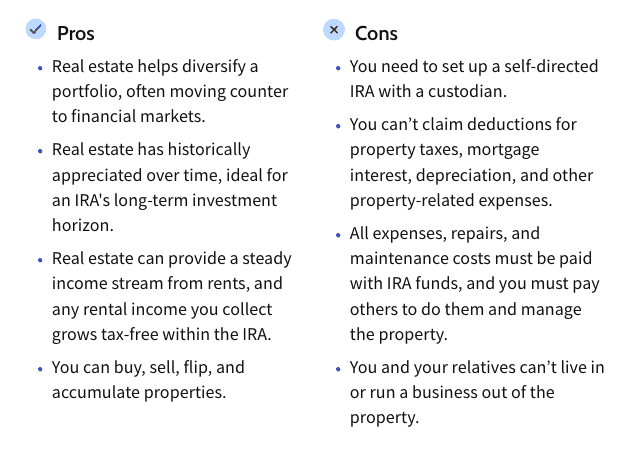

3.) Tax-deferred retirement accounts

Advanced investors can use a self directed IRA can buy real estate tax-deferred, which means they can invest in real estate now and pay the taxes on it later. Though this may not be as straight forward or simple as other real estate tax strategies, it can be useful for specific situations.

"Using a self-directed IRA to buy real estate comes with the potential for tax benefits. As is the case with any holding in your IRA, the income that goes into your IRA is not taxed until you take withdrawals. If you have a Roth IRA, you pay tax on your income as usual. Then, your investment gains will grow tax-free and can be withdrawn tax-free, as well" says Scott Spann on The Balance.

Please note that depending on the account, there could be annual contribution limits and they could restrict certain investments.

4.) Self-Employment and FICA Tax

Those who are self-employed must pay both the employer and employee portion of the FICA tax, this covers social security and medicare.

But, with rental property, the money you get from rent generally isn’t classed as earned income. Which typically allows you to avoid paying payroll tax on your investing earnings.

Here’s a quick example of how it works.

You own a business that brings in $130,000 each year in revenue. That would be classed as earned income, thus you must pay payroll tax.

But, with rental properties and the revenue they generate, this won’t be taxed. You’d be saving yourself $19,890 each year on payroll taxes at a rate of 15.3%. That’s more money to start saving for another rental property!

5.) Opportunity zones

Opportunity zones are areas that experience low-income or disadvantaged areas of land. In theory, these zones entice investors to spend money buying land in these areas and developing it, in return for tax breaks.

This will in turn economically stimulate the surrounding communities. As a group, with other real estate investors, you’ll place any unrealized capital gains into a qualified opportunity fund, which then goes towards improving the chosen area.

The tax breaks you benefit from include:

You can defer capital gains until 2026 or until your stake in the fund is sold;

You can grow your capital gains by 10% if you hold the fund for five years and 15% gains for 7 years;

If invested in the fund for 10+ years you can avoid paying any capital gains.

Tax benefits of real estate investing FAQ

What tax benefits can you get by investing in real estate?

While the actual tax advantages depend on a variety of factors and local laws of the real estate investor, you can typically expect to be eligible for the following tax benefits.

Capital gains tax;

1031 exchange;

Self-employment tax;

Tax-deferred retirement accounts;

Deprecation;

Pass-through deductions.

Can you right off property taxes when investing in real estate?

In general, qualified real estate investors are eligible to deduct $10,000 (or $5,000 if married and filing separately.)

What is the 1031 exchange rule?

The 1031 exchange is a tool that can be used by real estate investors to swap out an investment property for another property and defer capital gains or losses on that transaction.

Shared content and posted charts are intended to be used for informational and educational purposes only. Parcl does not offer, and this information shall not be understood or construed as, financial advice or investment recommendations. The information provided is not a substitute for advice from an investment professional. Parcl does not accept liability for any financial loss or damages. For more information please see the terms of use.

Parcl Team