Parcl Testnet 3.0 Is Live

We’re excited to announce Parcl Testnet 3.0 is live. Read this guide to learn how to get started.

Parcl Team

Aug 1, 2022

We’re incredibly excited to share that the Parcl Testnet 3.0 is now live! Testnet 3.0 will be open starting today, Monday June 27th, and run through Friday, July 1st, 5 PM EST.

Testnet 3.0 is the final leg of our preparations, before our Mainnet launch that will be happening towards the end of July.

After the incredibly successful Testnet 2.0 which lasted from May 23rd - May 28th, our team has been working tirelessly to implement suggestions and feedback to make the Parcl experience even better.

If you’ve participated in Testnet 1.0 or Testnet 2.0 you’ll notice a very similar experience across the board. That said, we have made several major improvements since the conclusion of Testnet 2.0

In this article, we wanted to share what Parcl is, highlight improvements we’ve made since Testnet 2.0, as well as help you get up and running so you can experiment with Testnet 3.0. As always, your feedback is incredibly helpful, so please don’t hesitate to share using our contact form or through the “feedback” button on the Testnet homepage.

As with previous Testnets, you’ll be using USDC and Solana Testnet coins and not actual crypto. You will however, need a Solana wallet, such as Phantom. Be sure to check out our How to Set Up Your Phantom Wallet guide if you need a hand getting started.

For those new to the world of crypto, we highly suggest you start with the “Trade” section, as it’s the most straightforward and intuitive.

Advanced users can experiment with both our Pool and Borrow features which have been heavily enhanced since the conclusion of Testnet 2.0

For a more detailed guide on these options you can refer to our previous documentation from Parcl Testnet 1.0, as well as our how to add liquidity sectionfrom Parcl Testnet 2.0.

Getting started: Add USDC and SOL via the faucet

Before you can get started, you’ll need to add both USDC and SOL Testnet coins via the “Faucet” page. Again, this is NOT real crypto. Connect your Phantom wallet to the Testnet page and simply deposit the desired Testnet amount of USDC and SOL.

A few SOL and a couple hundred USDC is more than enough to get started.

Once complete, you’ll be ready to test the waters of all Testnet 3.0 features.

Below we’ll share a brief overview of each of the Trade, Pool, and Borrow pages, then highlight the new improvements and other notes we made for Testnet 3.0.

Trade

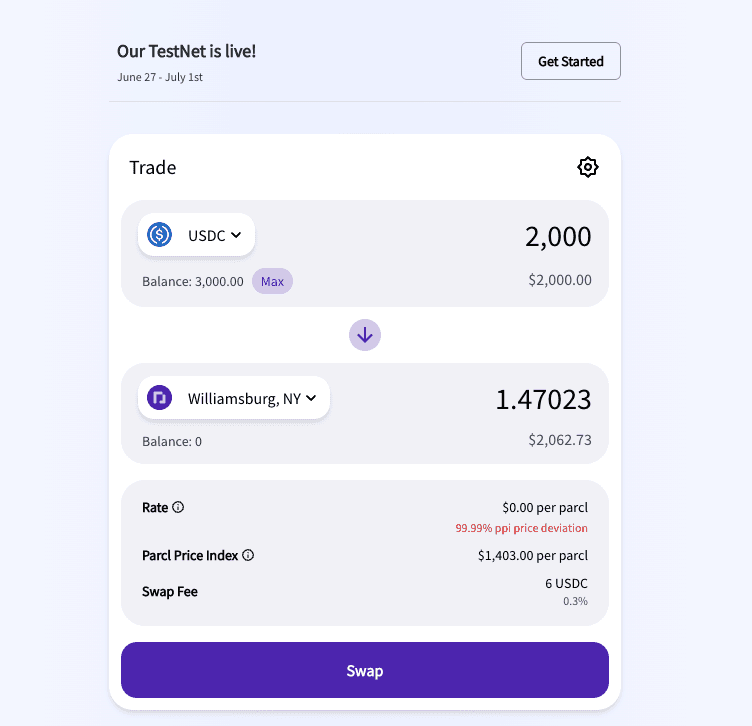

The Trade page allows you to trade your USDC for a Parcl of a specific neighborhood. In the example below, we are exchanging 2,000 USDC for 1.47023 “Parcls” of Williamsburg, NY.

Congratulations you now own 1.47 digital square feet of the Williamsburg, Parcl. As the real world value of Williamsburg increases, so does your investment. If you’ve ever used exchanges such as Uniswap, the experience should feel similar. You can buy and sell your Parcls at anytime.

For Testnet 3.0 we have 6 neighborhoods and 3 cities to choose from.

Pool

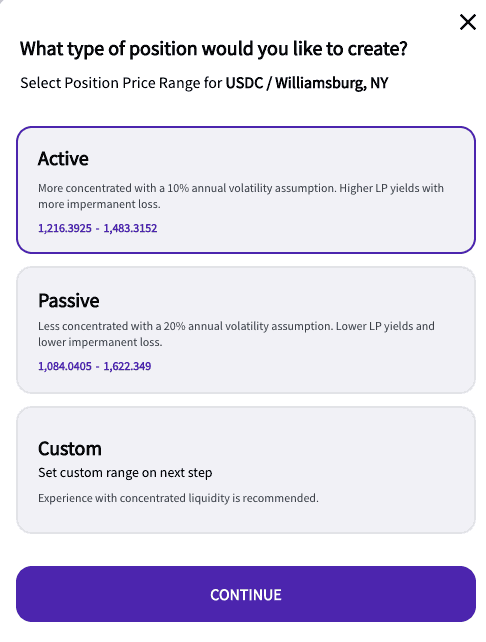

On the Pool page, you’re able to supply Parcls for traders to buy and sell in exchange for trading fees. Providing liquidity is a more advanced way to participate in Parcl by providing liquidity for the AMM and to earn trading fees. This ultimately helps ensure there’s a healthy market for buyers and sellers.

Depending on your investing goals, you can choose from “active” “passive” or “custom” positions.

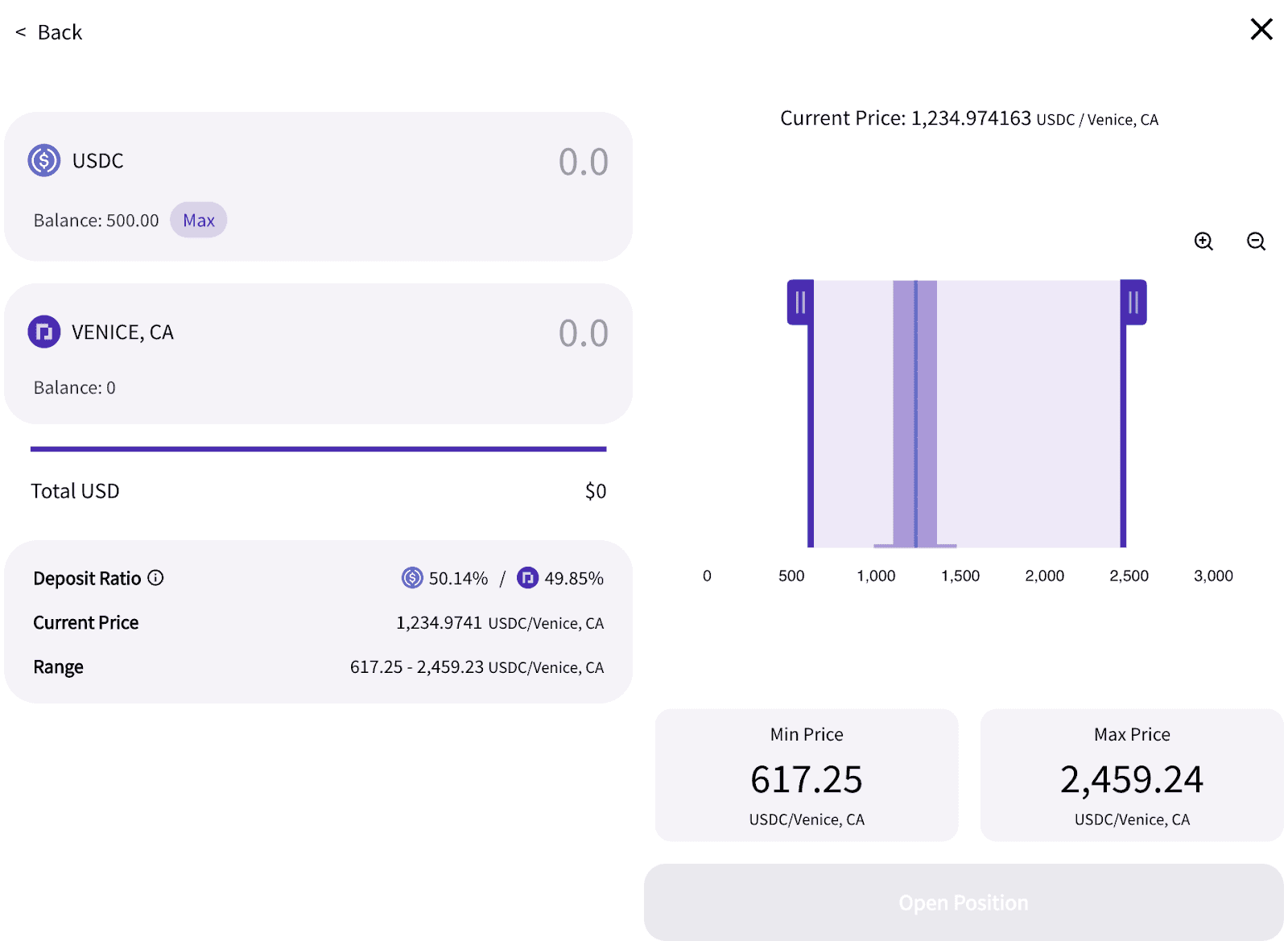

If you’re looking for more advanced customization you can setup your own custom range by clicking the "Custom" button which will bring you to the page below. This setting was designed for those who have previous experience with concentrated liquidity.

Borrow

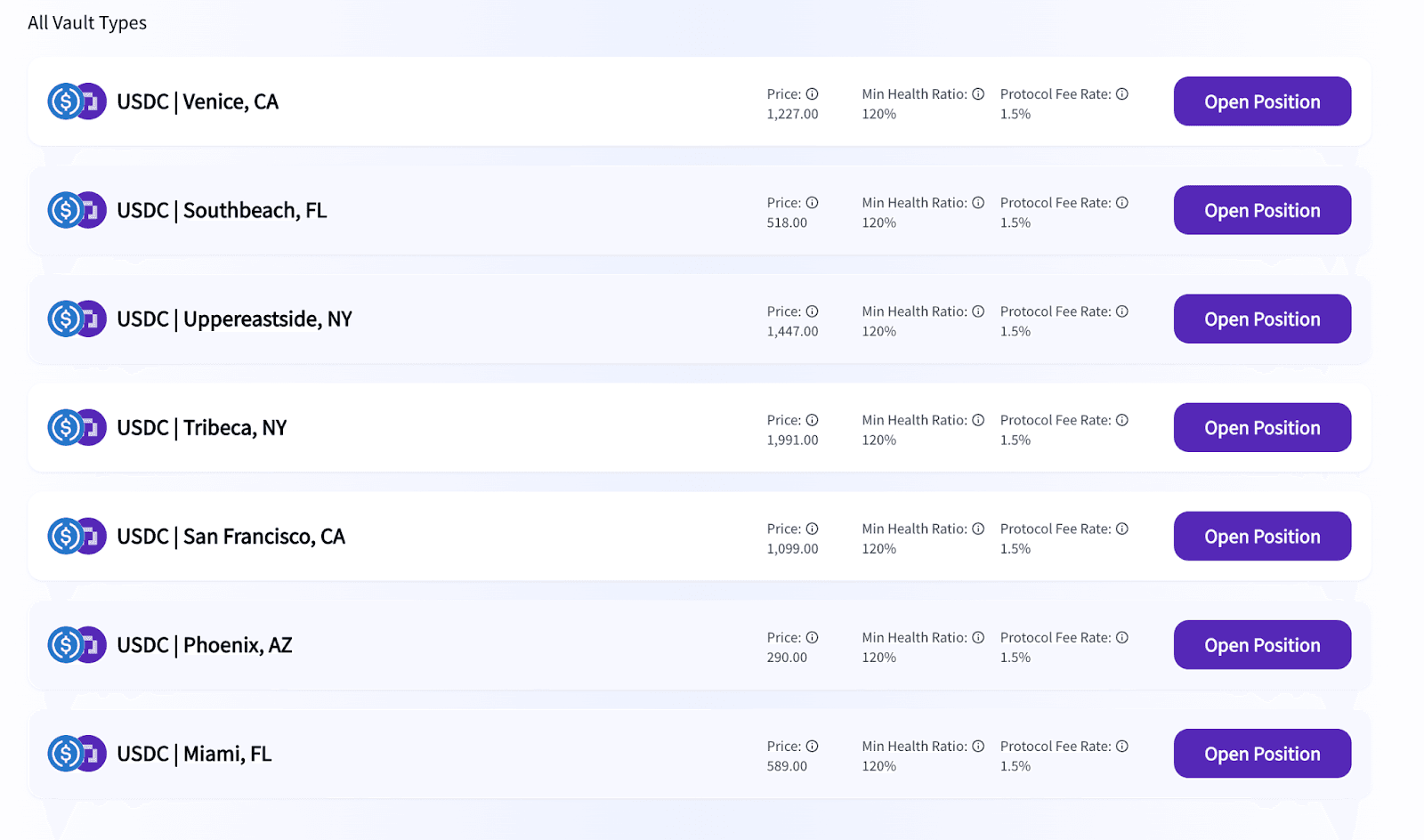

On the Borrow page, you can deposit USDC as collateral, against which you can borrow Parcls for specific neighborhoods or cities. For each borrow transaction, the protocol mints new Parcls, whereas for each Parcl debt repayment transaction the protocol burns the Parcl. These debt positions are over-collateralized to ensure the protocol is stable and secure from a risk management perspective.

Borrowing allows you to get access to Parcl which can then be used in the trading protocol to earn trading fees via an LP position or elsewhere in the DeFi ecosystem as other developers compose with the Parcl V1 smart contract protocol. Additionally, for advanced users, borrowing Parcls and selling them is functionally equivalent to a short position.

Now that we’ve covered each of the three core pages at a high level, let’s look at some of what’s been improved and refreshed since Testnet 2.0

Parcl Testnet 3.0 features

While the Parcl team has improved the entire user experience since Testnet 2.0, there are a few key improvements we want to highlight.

Live production price feed data;

Ability to invest in Cities in addition to neighborhoods;

Peg stability module;

Borrowing UI/UX refresh and enhancements.

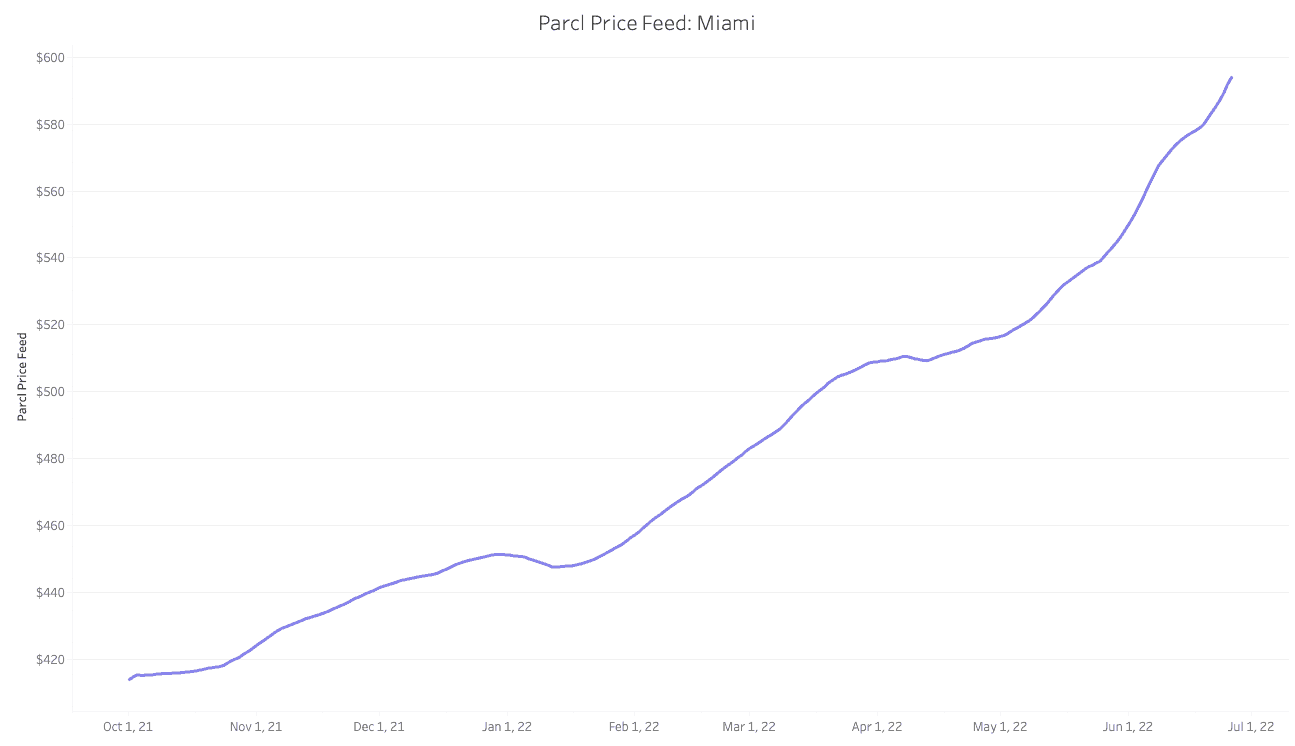

1. Live production price feed data

In Testnet 3.0 we’re thrilled to be incorporating the Parcl Price Feed data created by the Parcl Labs team. Parcl takes a unique approach to deliver the most up-to-date price estimate of real estate at any geographical level, e.g., cities, counties, metros, etc and we believe the Parcl Price Feed is the most effective way to estimate real estate prices.

You can learn more about how we approach data on our Introduction to Parcl Labs article. The data from Parcl Labs powers everything we do here at Parcl.

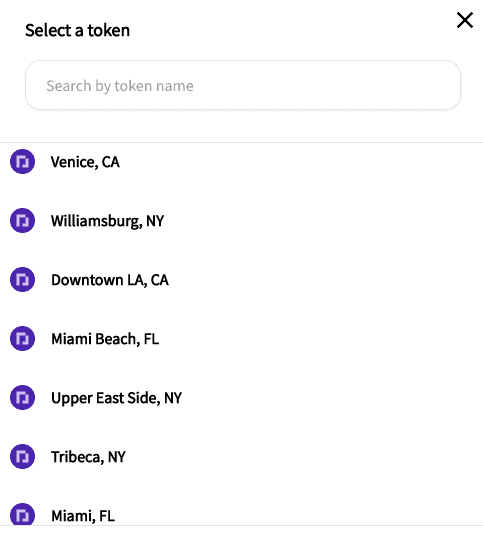

2. Ability to invest in Cities in addition to neighborhoods

With Parcl Testnet 3.0, we are also happy to announce you can now invest in both cities and neighborhoods. Want to invest in Downtown LA? How about Venice CA? With the latest update you have plenty of options to choose from. This brings us closer to our goal of giving Parcl a wide range of cities and neighborhoods to invest in.

3. Peg stability module: A focus on stability

One of the most exciting parts about Testnet 3.0 is that our smart contract code has been updated and improved since our 3rd audit.

With Testnet 3.0 we aim to continue to test the protocol’s newest updates. Specifically, we’ve added peg stability pools, which can be used by developers and traders to arbitrage AMM prices for Parcls back to the oracle peg, which is the Parcl Price Feed. The peg stability pools facilitate swaps specifically at the oracle price. The pool mints Parcls in one direction in exchange for collateralized tokens. In the other direction, the pool sends out existing collateral tokens in exchange for Parcls which are then burned and removed from supply.

This added feature allows us to continue to improve the stability of the Parcl protocol and ecosystem while helping us stress test the current state of the protocol.

4. Borrowing UI/UX refresh and enhancements

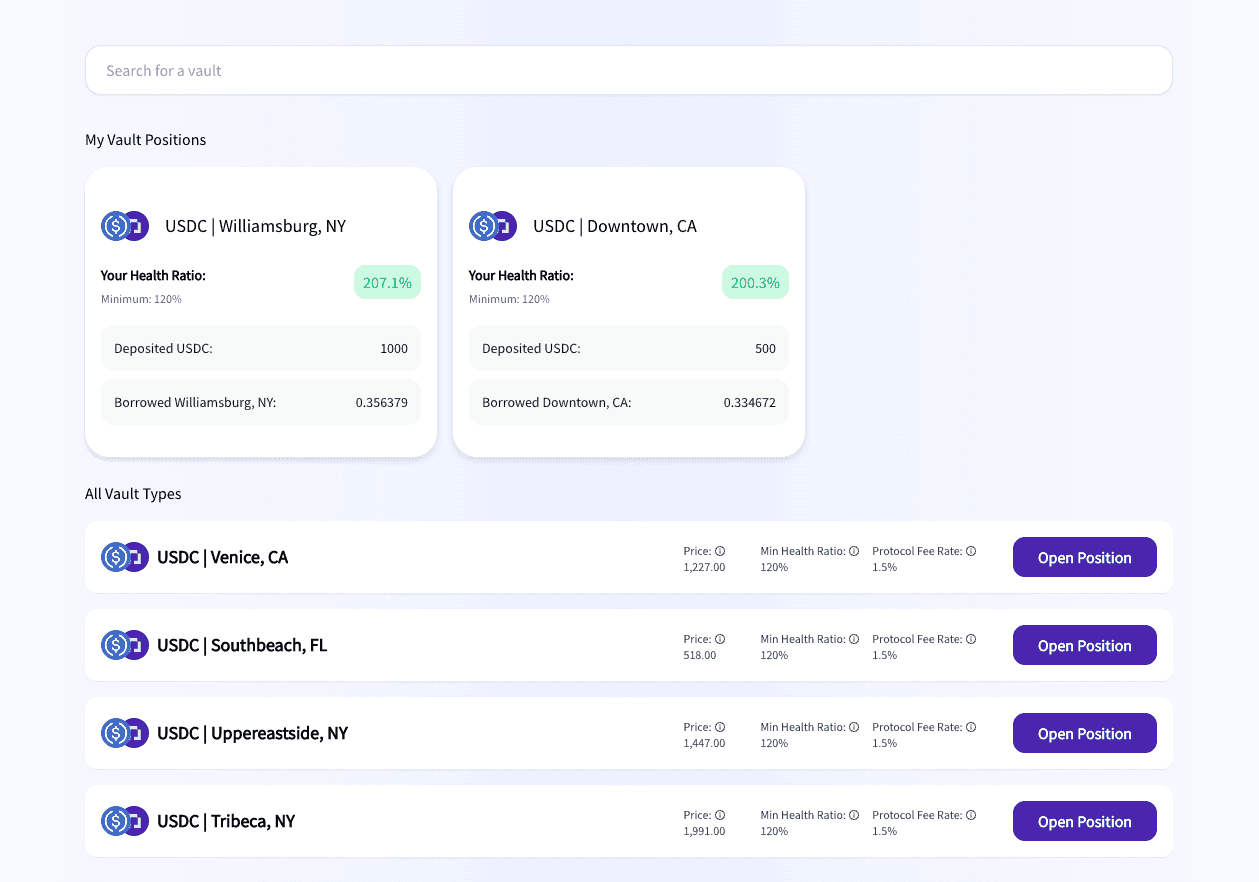

We’re further excited to highlight the improvements of our Borrow page.

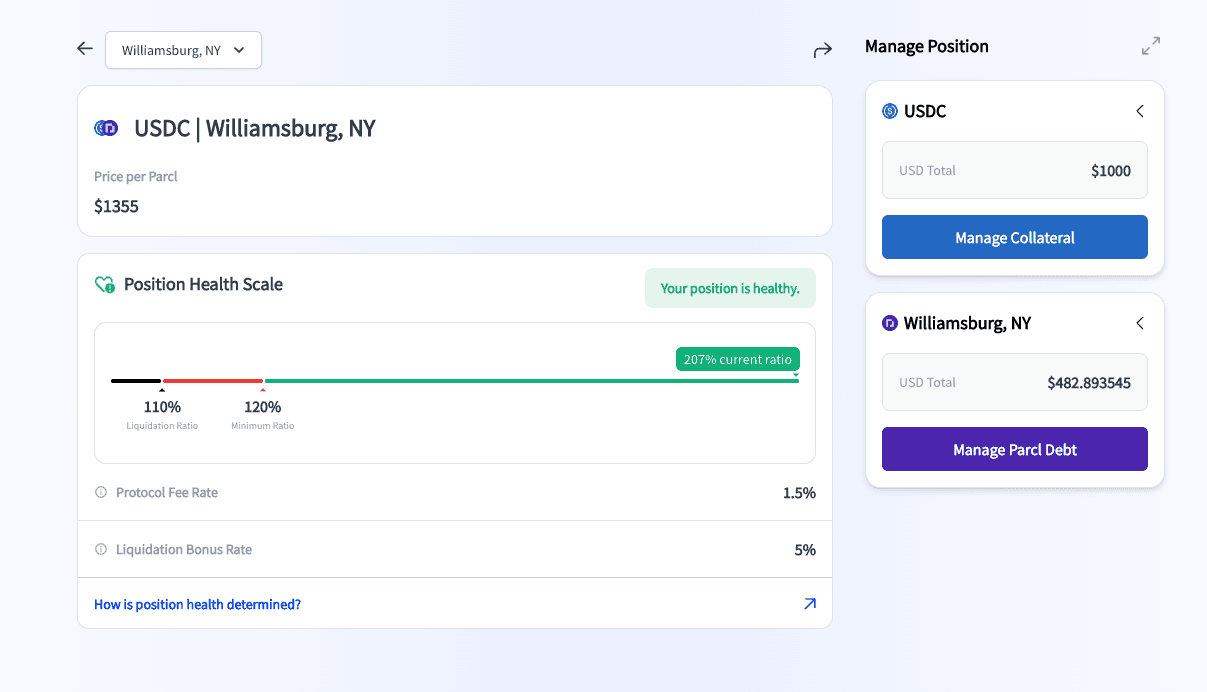

On the “Borrow” page, you can quickly see your “vault positions'' depending on which positions you have open. We’ve worked hard to simplify the user experience making it easier to understand the health of your positions. We believe, one of the biggest areas of opportunity in crypto and Web3 is working towards thoughtful and intuitive UI/UX, which is why we continue to test and improve Parcl based on user feedback. We’re inspired by the many DeFi and TradFi systems who invest heavily in improving their UI/UX.

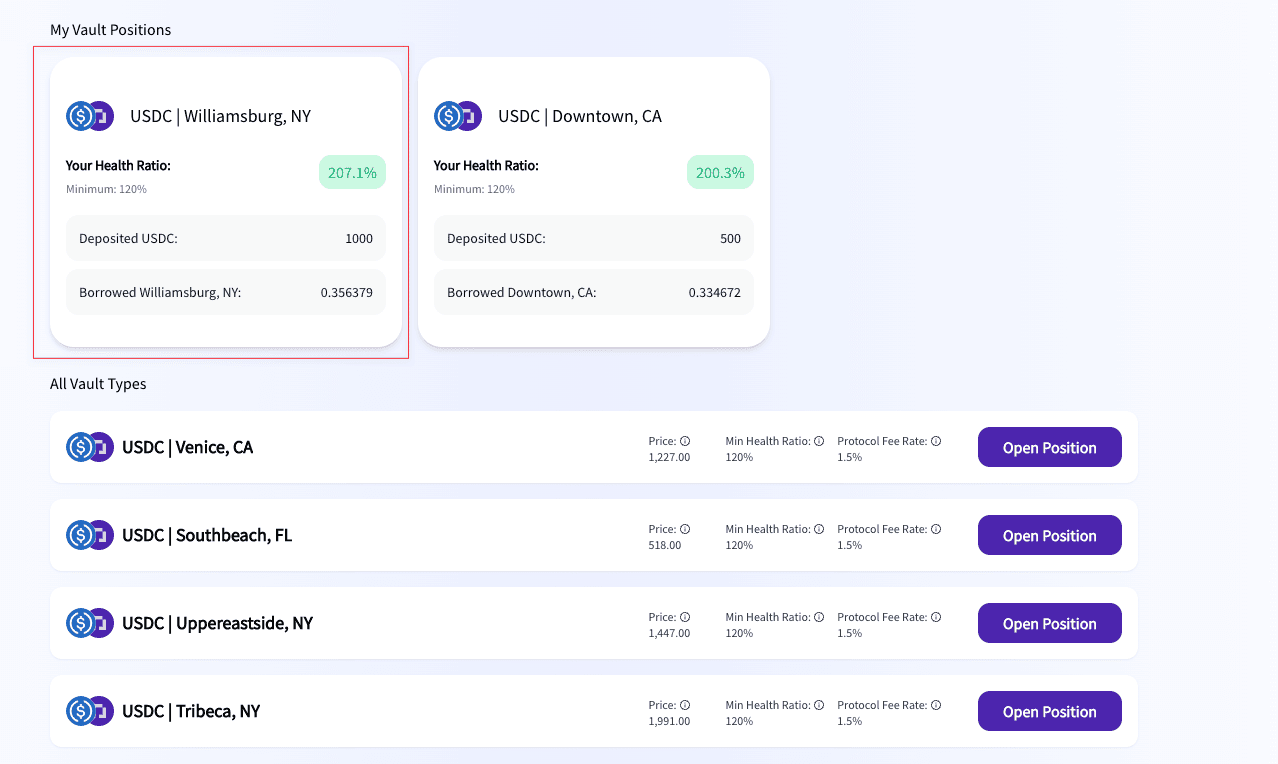

In the example above, we have positions for both Williamsburg, NY and Downtown, CA.

Upon clicking one of your vault position cards, you’ll get access to a more detailed view of your vault position.

The minimum ratio refers to the minimum USD ratio of deposited collateral to borrowed Parcls. If it crosses the minimum ratio, then the vault position enters into a “buffer zone,” where additional borrowing and collateral withdrawals are frozen. However, the vault can still accept deposits and repayments, which both increase your health ratio. If your health ratio reaches the liquidation ratio, then the vault position is subject to partial or full liquidation.

Below the health ratio section there are other protocol risk management and related information. The protocol’s fee rate is applied to Parcl repayments and the liquidation bonus rate is the additional percentage of collateral liquidators earn for performing the liquidation–it incentivizes liquidators and keeps the protocol healthy.

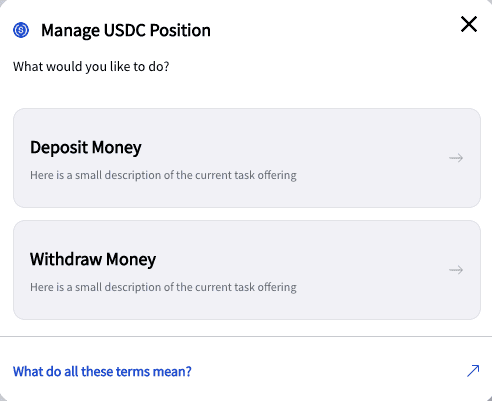

You can also manage your collateral and Parcl debt from the vault position page.

By clicking the “Manage Collateral” button, you have the options of depositing or withdrawing USDC.

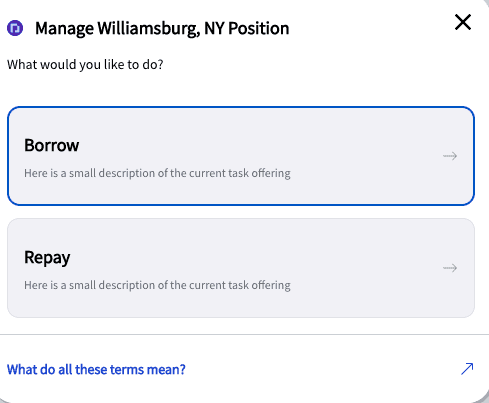

Clicking the “Manage Parcl Debt” button brings you to this page.

Here you have the option to borrow additional Parcls or repay Parcls.

What is Parcl?

Parcl is a seed-funded synthetic asset protocol that is on a mission to deliver real estate to everyone. The protocol allows for the creation of “Parcls” - smart contracts that are representative of the average price per square foot of real estate in a given geographical area.

Through Parcl, users can trade their favorite neighborhoods just like they would trade Bitcoin, Ethereum, or other crypto assets. By creating a derivative platform for individuals (or institutions) to execute peer-to-contract trades, Parcl makes real estate investing faster, cheaper, and more liquid than ever before.

If this is your first Parcl Testnet experience be sure to watch this short video about Parcl below. This will give you a very high overview of how to get the most out of your Testnet experience. Don’t worry if things don’t look exactly the same as you experiment with Testnet 3.0. The core product features remain the same.

With Testnet 3.0 you’ll be able trade, pool, and borrow, as well as check out your very own Parcl dashboard.

We hope this brief guide is helpful in getting started with Testnet 3.0.

If you haven’t already, be sure to join our Discord channel, where we’ll be sharing even more tips and suggestions for getting the most out of your Parcl experience.

We couldn’t be happier about the launch of Testnet 3.0 and the Mainnet launch coming up in July. Stay tuned for more updates.

Shared content and posted charts are intended to be used for informational and educational purposes only. Parcl does not offer, and this information shall not be understood or construed as, financial advice or investment recommendations. The information provided is not a substitute for advice from an investment professional. Parcl does not accept liability for any financial loss or damages. For more information please see the terms of use.

Parcl Team