Getting Started: How to Pool (LP) on the Parcl Protocol

Parcl Protocol is finally here! Here’s everything you need to know about the Parcl Pool feature and becoming a liquidity provider.

Parcl Team

Sep 13, 2022

Welcome to the How to Pool on Parcl guide. The Parcl Protocol Pool feature allows users to become liquidity providers (LP) and earn potential trading fees in the process.

This guide will cover why a user would consider providing liquidity on the Parcl Protocol and the steps required to open a Pool position on the Parcl Protocol.

Want to watch a video instead? Find the How to Pool on Parcl video embedded below.

Why should you provide liquidity to the Parcl Protocol?

Providing liquidity shouldn’t be confusing and difficult to do. The Parcl Protocol Pool interface was designed to be simple and easy to use.

In return for “pooling” your assets, you’ll have the ability to earn trading fees. The fees earned will ultimately be determined by which assets you pool.

Here are a few reasons you should consider providing liquidity with the Parcl Protocol.

Earn fees through LPing: Parcl allows traders to easily earn fees by providing liquidity. LP’s are eligible for the majority of the trading fee pool.

Easily manage your active positions: Adjusting your LP position has never been easier. Parcl’s intuitive Pooling interface allows you to quickly add or remove liquidity and collect accrued trading fees

Select custom liquidity ranges: Parcl allows you to choose custom LP positions with specific price ranges. Perfect for the experienced traders looking to potentially profit off their knowledge of real estate markets.

Getting started

In order to use the Parcl Protocol Pool feature, you’ll first need to purchase Parcls of your favorite neighborhood and cities using the Parcl Protocol Trade feature.

If you don’t already own any Parcls check out How To Trade With Parcl

You’ll also need to have deposited your desired amount of USDC to your Solana wallet. Remember, to get started pooling, you will need to have roughly equal amount of USDC and your selected Parcl token.

How to Pool (LP) with the Parcl Protocol

As a liquidity provider, you can gain exposure to the real estate market by being a “market maker.”

By pooling your assets (½ Parcl ½ USDC) for example, your tokens become the tokens other traders swap with. Pooling with Parcl is the same as “LPing” which is short for liquidity providing. You may seen the terms pool and LPing used interchangeably.

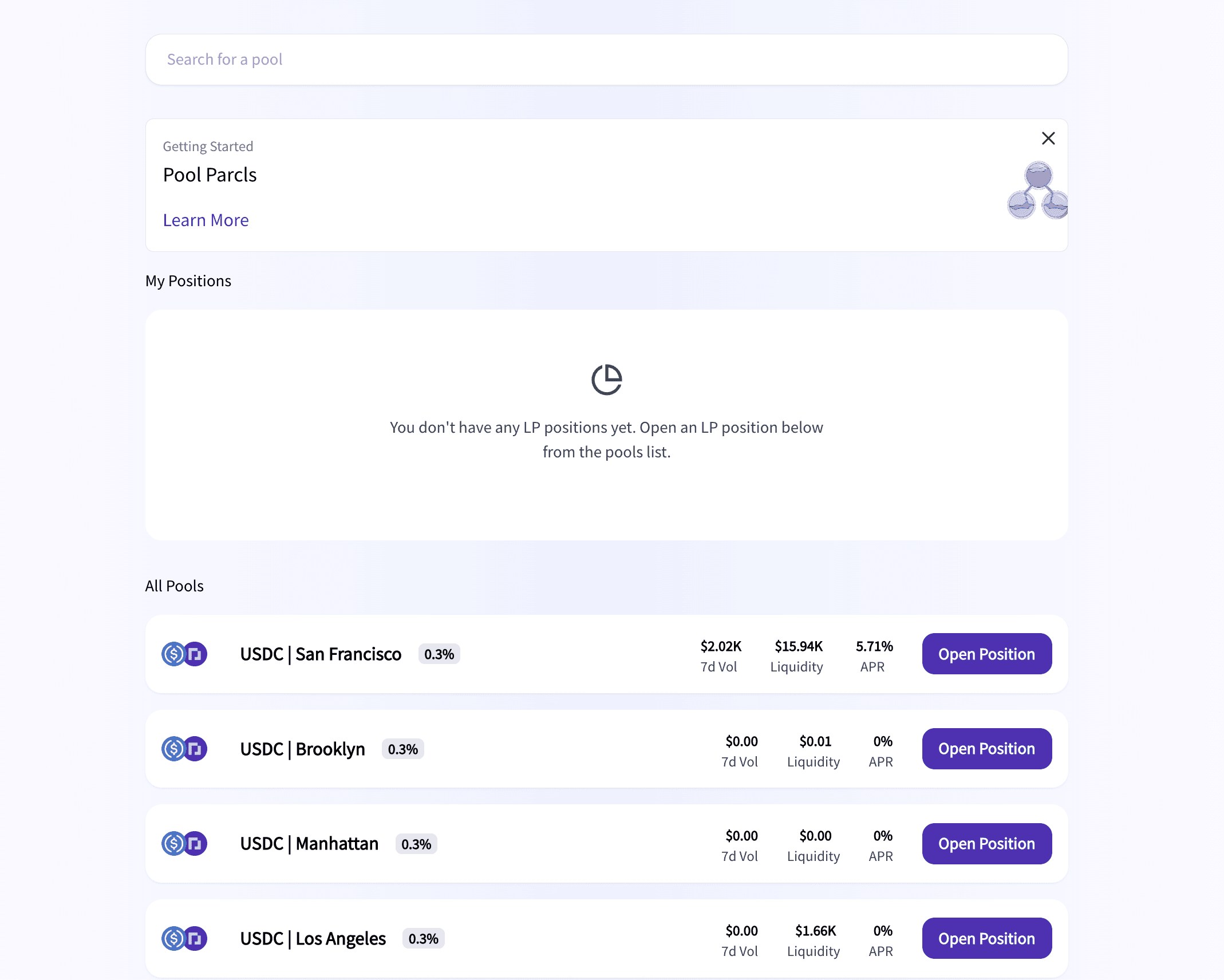

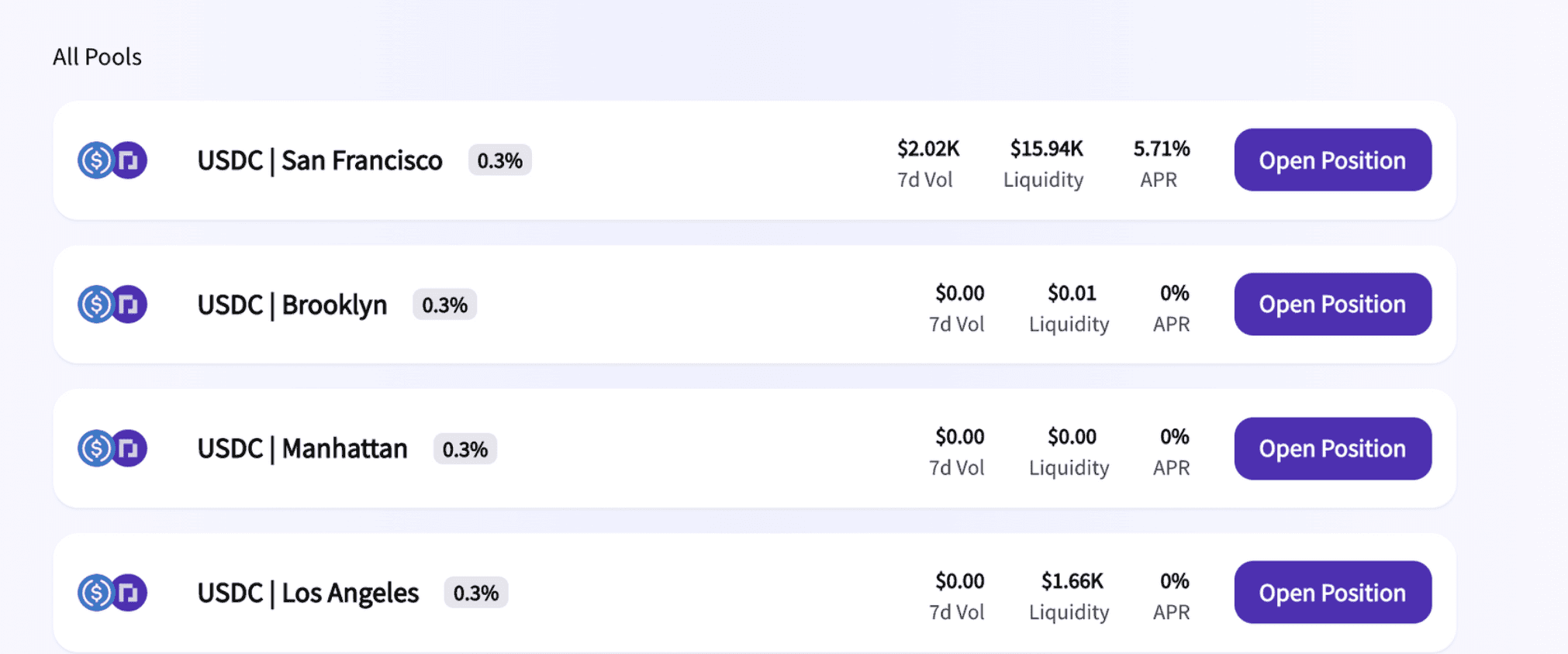

To get started, click on the “Pool Page’ here you’ll see all the accessible Pools that Parcl offers.

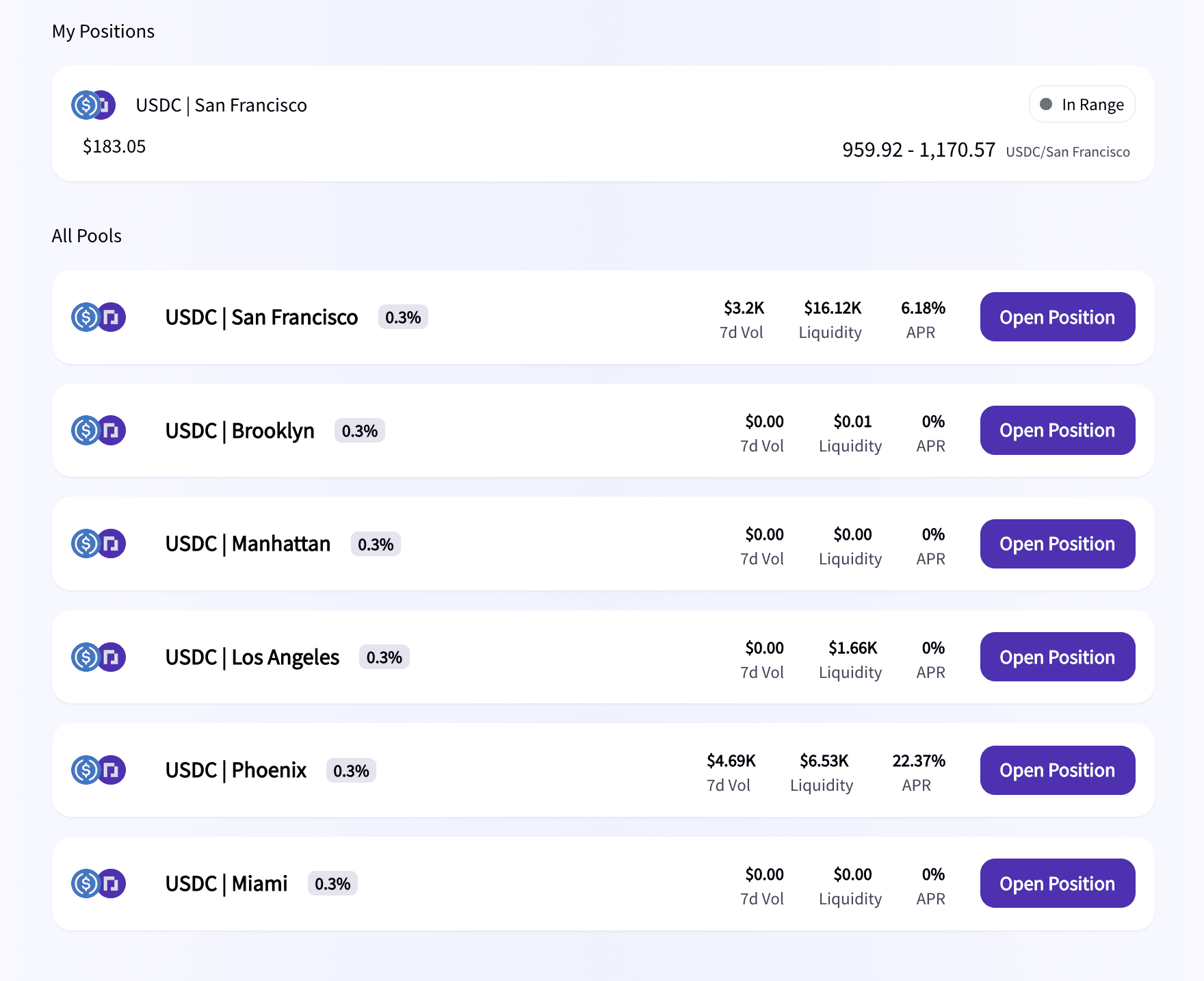

Here you’ll also be able to see the 24h volume, total liquidity, and the current APR %.

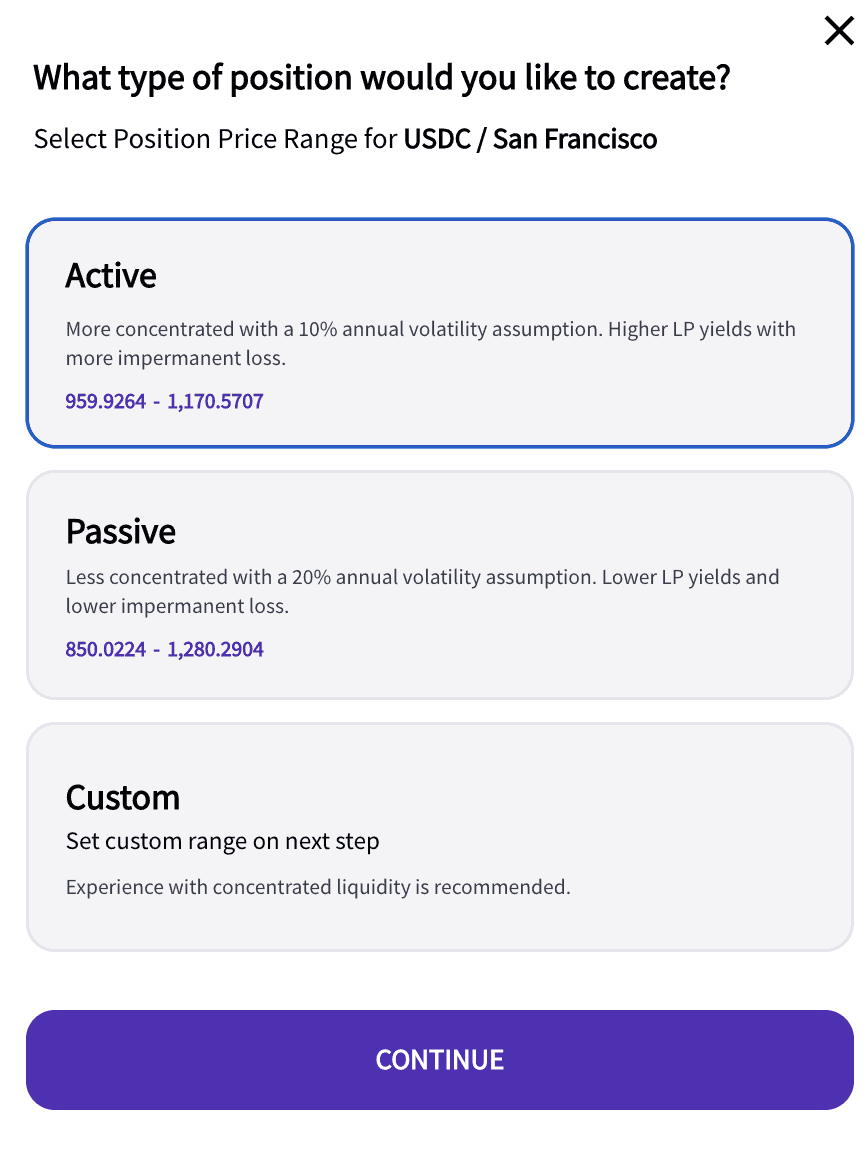

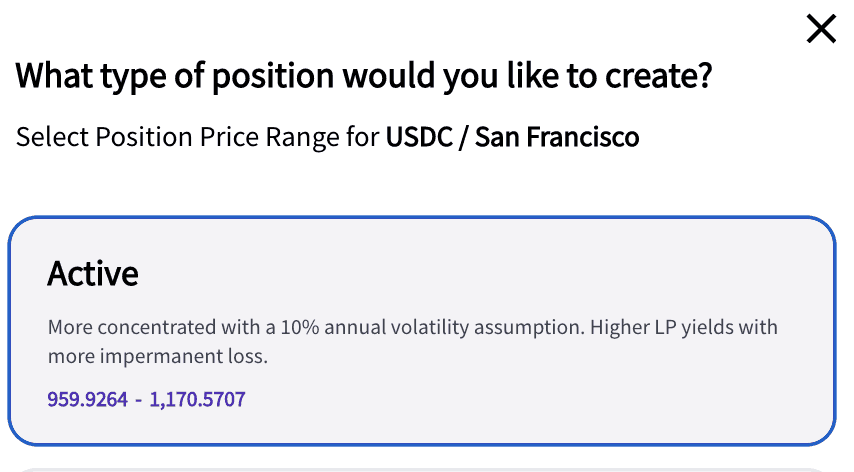

Clicking “Open Position” will bring us to the Position Price Range module where you have three options to choose from.

Active

This option is great for those looking to be active in monitoring real estate prices and checking in on their Parcl Protocol Portfolio daily. This price range is more concentrated with a 10% annual volatility assumption. Active allows for higher potential LP yields, but has an increased possibility of impermanent loss.

Passive

This option is great for those looking for a more stable position that is more “hands off.” The passive range is less concentrated with a 20% annual volatility assumption. This price range provides lower yields than “Active” but has a decreased chance of impermanent loss.

Custom

Perfect for more experienced liquidity providers, the Custom option allows you to choose your desired price range to maximize your potential yields. Since Parcl leverages a concentrated liquidity smart contract, LPs can open positions in specific price ranges.

For example, if you have SF Parcl tokens and USDC, and believe that USDC trades will occur between $500 and $2,000 per sqft, then you choose that range and earn yield based on the accuracy of your assumptions.

Again, it is strongly suggested that a user has extensive experience providing liquidity and knowledge of real estate when choosing a Custom price range.

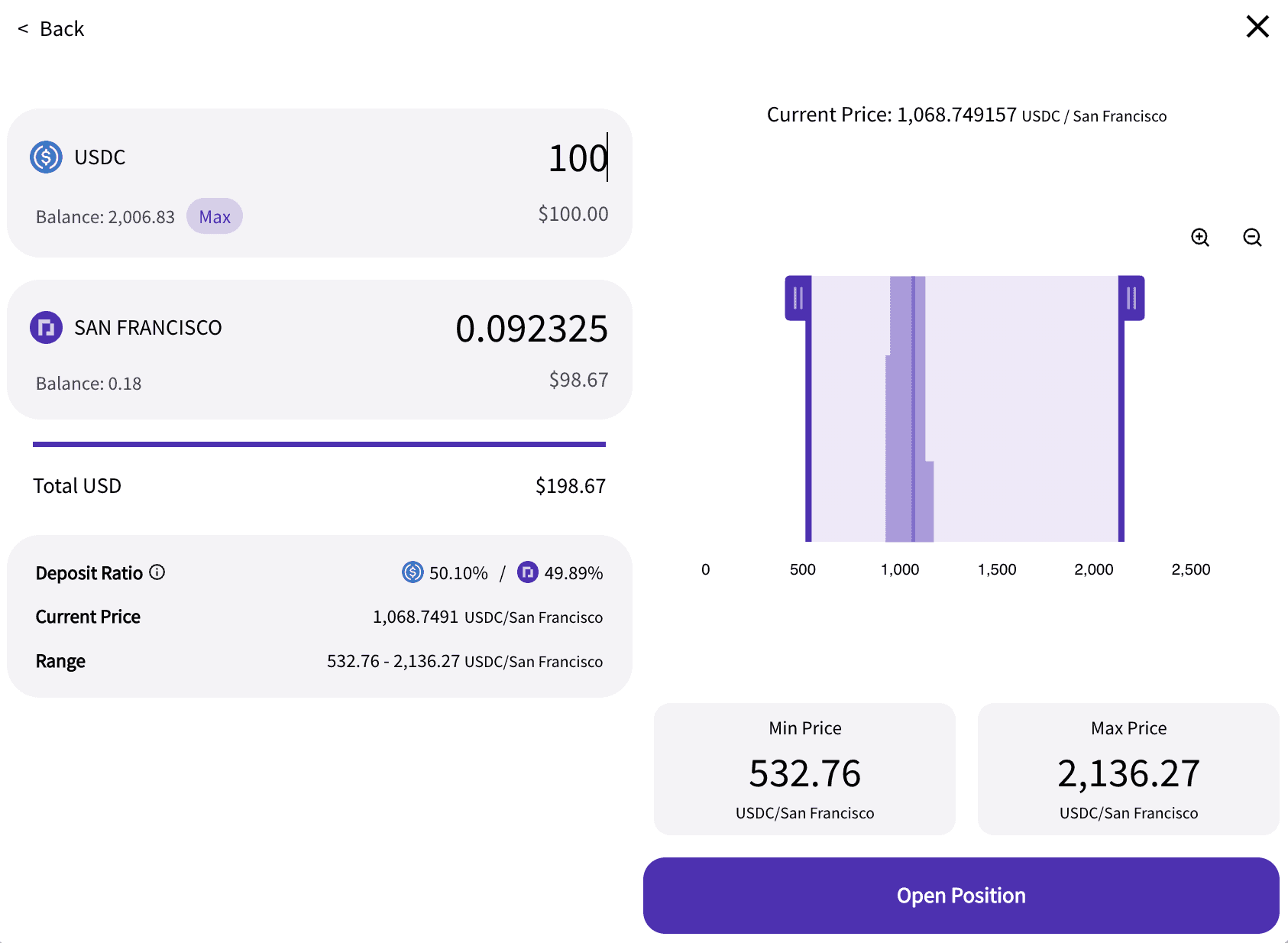

Here’s the “Active” option.

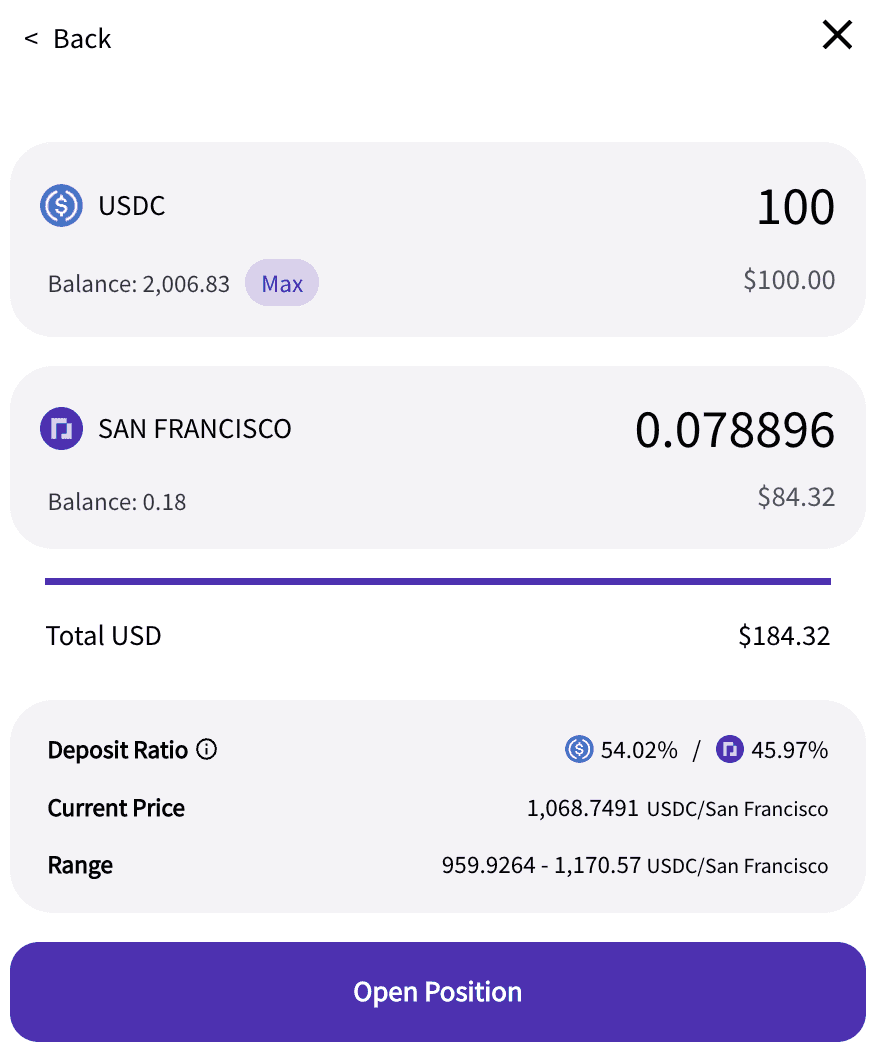

In this transaction, there is $100 USDC and .078896 Parcls of San Fransisco. Again, when providing liquidity, you’ll need roughly the same amount of each asset (USDC + San Fransisco, CA Parcl)

Before opening your position, you can see the Deposit Ratio, Current Price, and the Price Range. The Deposit Ratio refers to the ratio of USDC / Parcls based on the current price and positions of your boundaries.

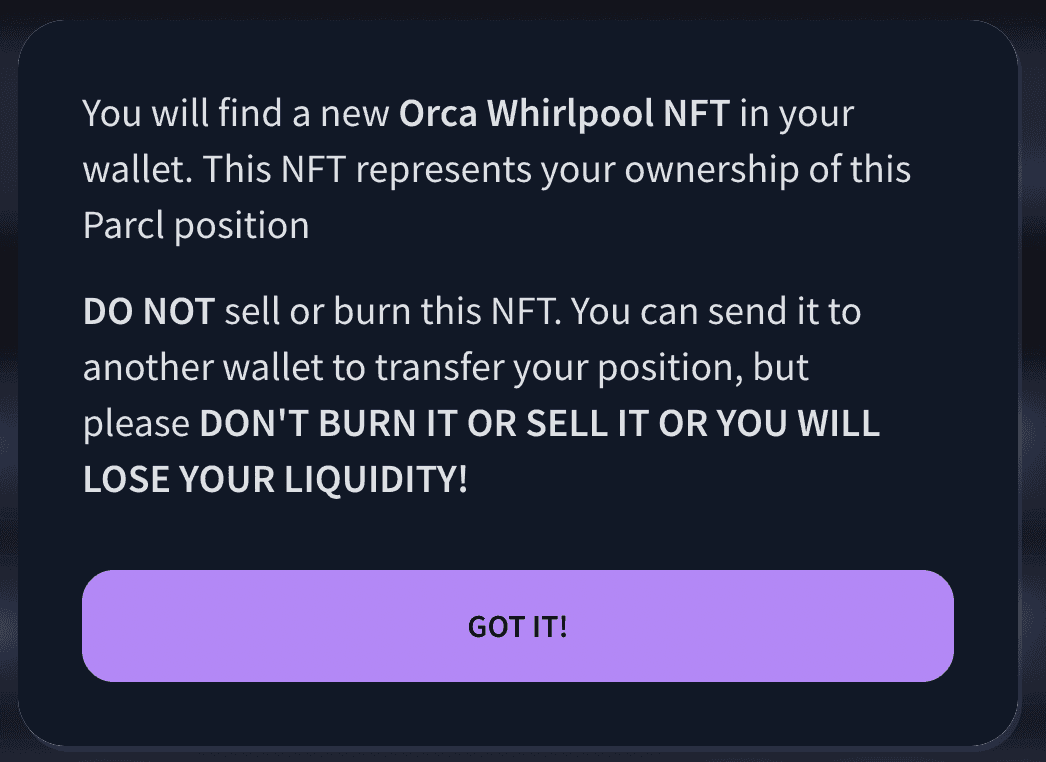

Next click “Open Position” and approve the transactions in your Solana wallet. You'll see this warning here.

The metadata of Orca Whirlpool position will look like:

The Pool Positions page will now look like:

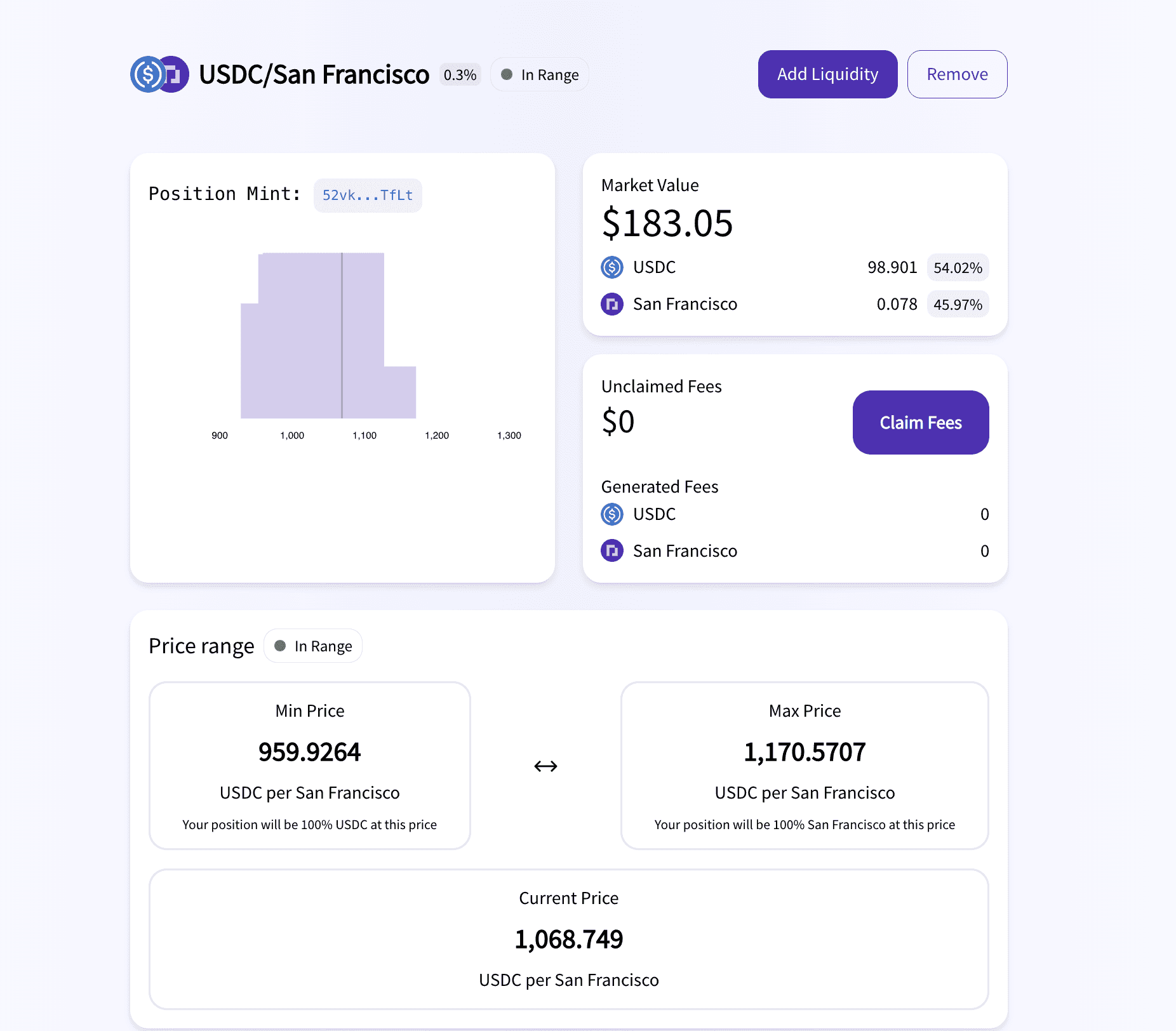

Clicking a specific position, will bring you to a detailed look at that positions performance.

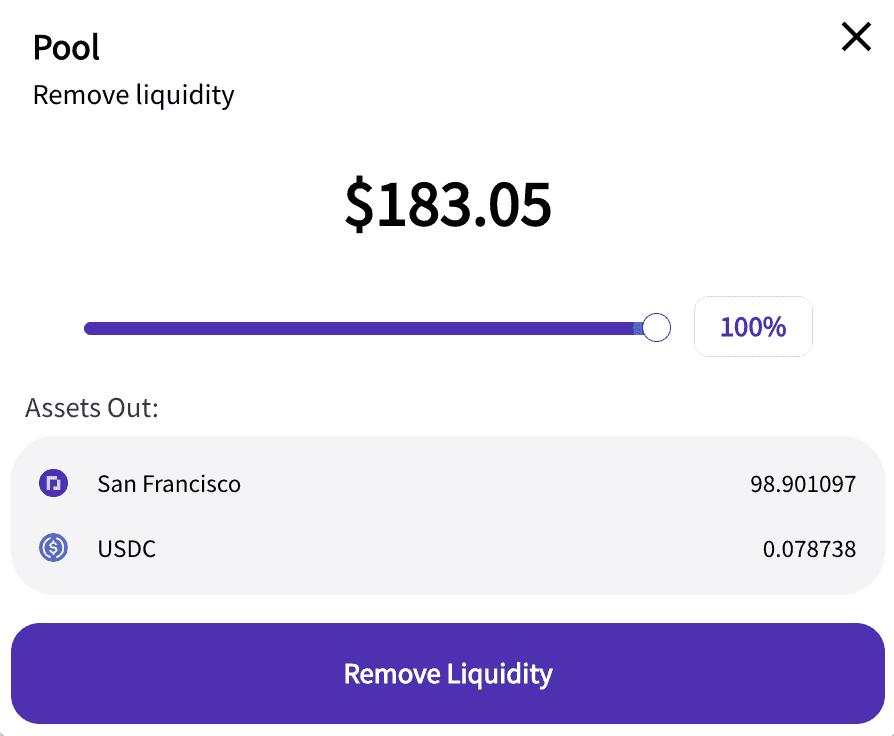

You can add or remove liquidity at any time.

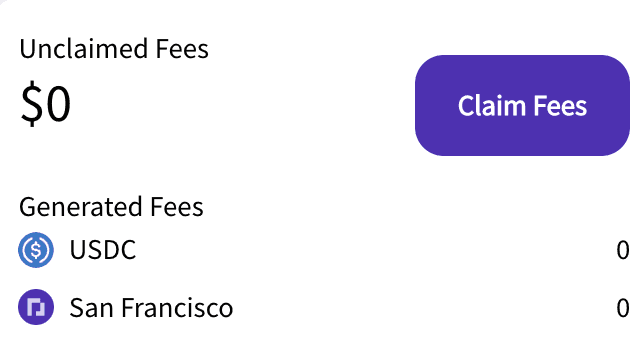

In the unclaimed fees section, you can also claim your LP fees at anytime.

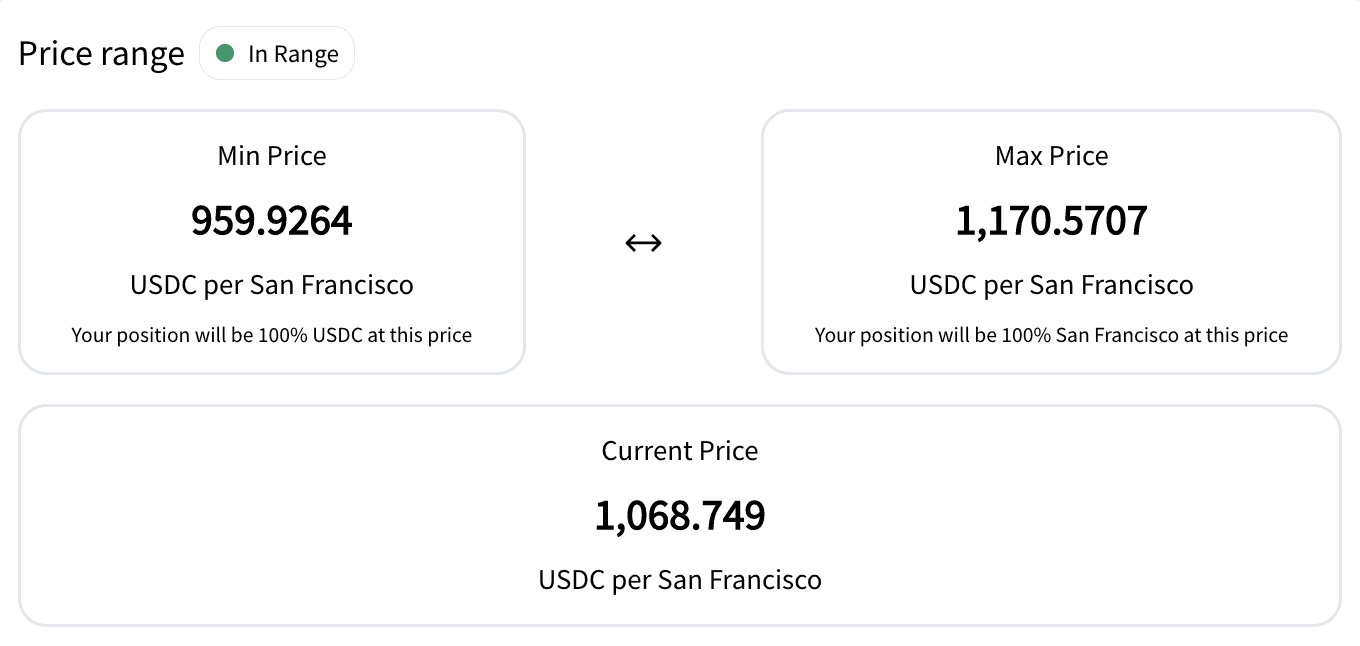

At the bottom, you can see your current price range as well as the current price of your Parcl in USDC.

Congratulations you have now opened your first pool position with the Parcl Protocol.

Questions? Need help? Be sure to follow Parcl on Twitter and join the Discord for more on the latest news and developments around Parcl and the Parcl Protocol

If you’re looking to Trade or Borrow with the Parcl Protocol, be sure to check out the additional Parcl guides here:

Shared content and posted charts are intended to be used for informational and educational purposes only. Parcl does not offer, and this information shall not be understood or construed as, financial advice or investment recommendations. The information provided is not a substitute for advice from an investment professional. Parcl does not accept liability for any financial loss or damages. For more information please see the terms of use.

Parcl Team